How to Find the Best Amazon Keywords: A Performance-First Guide

Stop guessing. Learn a performance-first workflow to find the best Amazon keywords using PPC and organic data to drive real sales and scale your brand.

The best Amazon keywords aren't the ones with the highest search volume. They're the ones that drive profitable conversions. A winning keyword strategy is built on performance metrics like conversion rate (CVR) and return on ad spend (ROAS), not vanity metrics. This is the difference between simply spending on ads and building a scalable growth engine.

Rethinking Your Search for the Best Amazon Keywords

The traditional approach to keyword research—hunting for high search volume—is broken. It leads to wasted ad spend on hyper-competitive terms, low conversion rates, and endless bidding wars. It's time for a mindset shift.

The only true measure of a keyword's value is its ability to generate profitable sales. Metrics like cost-per-acquisition (CPA) and ROAS cut through the noise. A keyword with 50,000 monthly searches is worthless if it never converts. Meanwhile, a niche long-tail term with 500 searches could be your most valuable asset if it consistently drives high-margin sales.

Using PPC as a Growth Engine

Your Amazon PPC campaigns are your single best market research tool. Every dollar spent on Sponsored Products is an investment in data, revealing the exact search terms customers use right before they buy. This creates a powerful feedback loop: paid ad insights fuel your organic strategy, boosting rankings, sales velocity, and overall profitability.

According to Amazon's own data, brands that use both Sponsored Products and Sponsored Brands see, on average, a +40% increase in YoY sales. This isn't a coincidence; it's proof that a holistic strategy, where paid advertising informs organic growth, is the key to scale.

If you're just getting started and need a solid process, this step-by-step keyword research guide is a great place to begin building your initial list.

This visual from Amazon Advertising drives the point home, showing how PPC campaigns are woven into the entire customer journey.

The takeaway is that paid ads don't exist in a vacuum. They directly influence discovery and consideration, which in turn lifts your organic visibility and sales.

A Framework for Profitable Keywords

With over 1.9 million active sellers on the platform, you can't just throw keywords at the wall and see what sticks. A layered keyword strategy based on customer intent and your business goals is essential. This means separating your keywords into distinct jobs.

- Money Keywords: Your bread and butter. High-intent, long-tail phrases that scream "I'm ready to buy" (e.g., "waterproof hiking boots for men size 11"). They are the foundation of profitable, high-ROAS campaigns.

- Discovery Keywords: Broader terms that help new customers find you (e.g., "men's outdoor footwear"). They build awareness and fill the top of your funnel with qualified buyers.

- Competitor & Brand Keywords: Strategic offense and defense. Target competitor ASINs to intercept their customers and bid on your own brand terms to protect your turf from conquesting ads.

The table below breaks down the shift from vanity metrics to performance-first thinking.

Keyword Performance Tiers: From Vanity to Value

| Metric Type | Traditional Metric (Limited Insight) | Performance-First Metric (Actionable Insight) | Business Goal |

|---|---|---|---|

| Visibility | Search Volume | Impressions Share, Top-of-Search Rate | Brand Awareness |

| Engagement | Clicks, Click-Through Rate (CTR) | Cost Per Click (CPC), Add-to-Carts | Market Penetration |

| Conversion | Orders | Conversion Rate (CVR), Cost Per Acquisition (CPA) | Sales Velocity |

| Profitability | Ad Spend | Return on Ad Spend (ROAS), Ad Cost of Sales (ACoS) | Profitable Growth |

Ultimately, this performance-first approach connects every keyword to a tangible business outcome, ensuring your ad spend is a strategic investment, not just an expense.

The core takeaway is this: Stop asking "What are the most popular keywords?" and start asking "Which keywords drive the most profitable conversions for my brand?" This simple shift is the foundation of sustainable scale on Amazon.

Finding High-Impact Keywords in Your Own Data

Before you open a third-party tool, look inside your Seller Central account. Your most valuable, high-converting search terms are already hiding in plain sight, backed by your own sales data.

Mining your own performance data is the most direct path to discovering what actually motivates your customers to buy. We're not guessing or relying on estimated search volumes. The goal is to find the exact phrases real shoppers typed moments before they purchased your product. These keywords have already proven their value, making them the perfect foundation for scaling PPC and optimizing your listing.

Uncovering Gems in Sponsored Products Reports

Your Sponsored Products Search Term Report is a goldmine. It’s a direct log of every customer search that triggered your ads, complete with clicks, spend, and—most importantly—sales. This isn't theoretical data; it's a ledger of what works.

Actionable Insight: Download the report for the last 30-60 days. Filter it to show only the terms that generated at least one sale. These are your proven converters.

For example, you might be bidding on the broad term "yoga mat," but the report reveals the long-tail phrase "eco friendly cork yoga mat non slip" has a 35% conversion rate at a fraction of the cost. That's your cue. Move that powerhouse term into its own exact match campaign and give it the budget it deserves. When you're ready to expand on these findings, tools like Jungle Scout can help you find related opportunities.

Key Takeaway: Stop focusing only on what's spending money and get obsessed with what's making money. Isolate every single search term with a conversion and build a dedicated strategy around it. This is the fastest way to improve your ROAS.

This report also tells you what to stop doing. See a term like "cheap yoga mat" racking up clicks but zero sales for your premium product? Add it as a negative keyword immediately and stop wasting that ad spend.

Tapping Into the Search Query Performance Dashboard

For Brand Registered sellers, the Search Query Performance (SQP) dashboard offers a holistic view of your brand’s performance, connecting impression share, click-through rate, and sales for specific queries across both paid and organic traffic. It’s a game-changer.

This is where you spot growth opportunities. For instance, finding keywords with a high impression share but a low click-through share indicates a problem not with visibility, but with your main image, title, or price.

The real gold, however, is finding keywords with a low impression share but a high conversion share. This is a massive opportunity. It means on the rare occasions your product does appear for that term, shoppers buy it.

Imagine your SQP data shows the term "travel yoga mat lightweight" has only a 2% impression share but a 40% conversion share on its few clicks. Amazon is practically screaming at you to act.

- Immediately create a new PPC campaign targeting this exact phrase.

- Weave "lightweight travel yoga mat" directly into your product title and top bullet points.

By doing this, you're not chasing vanity metrics. You're strategically capturing market share on proven, high-intent keywords where you are currently invisible.

Uncovering Growth with Competitor and Niche Analysis

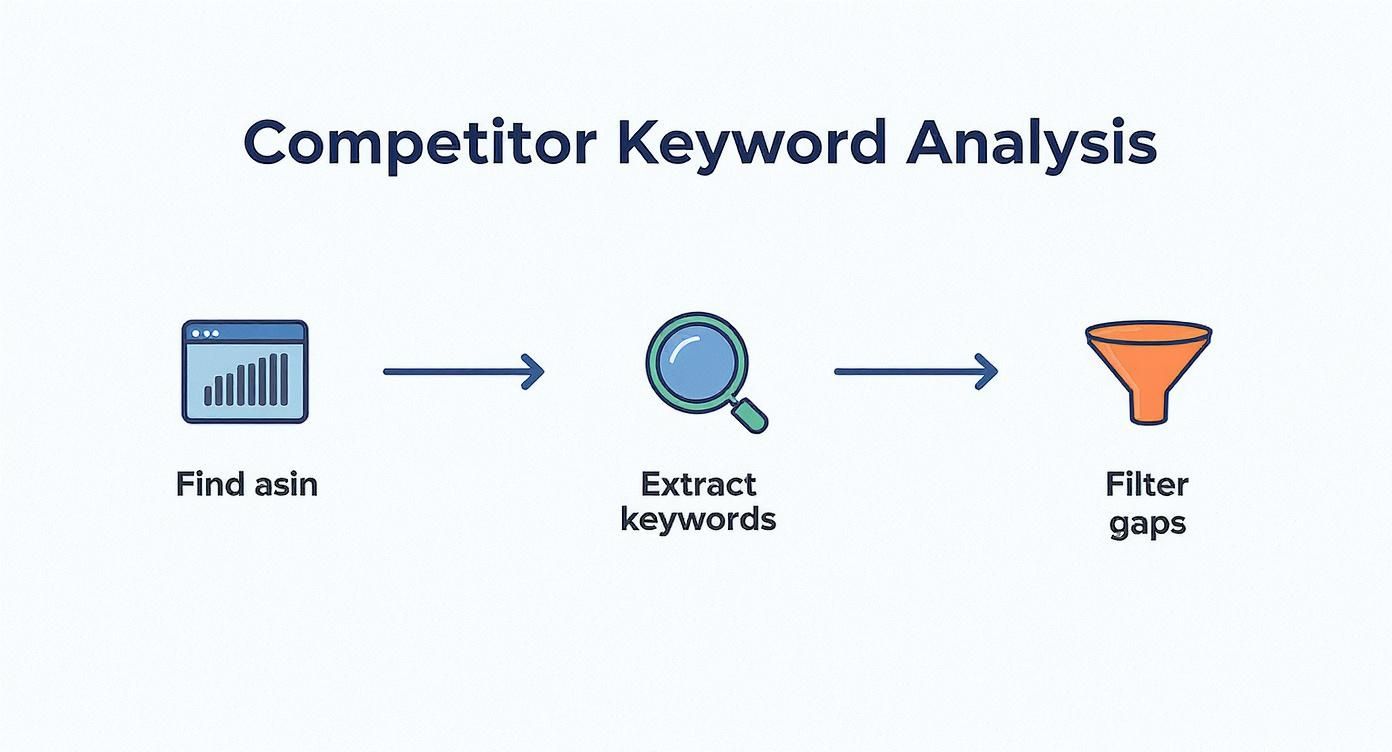

Once you’ve extracted maximum value from your own data, it's time to go on the offensive. The most direct path to growth is understanding what’s already working for your top competitors. Think of it as strategic intelligence gathering—finding and exploiting the gaps they've missed.

This means systematically deconstructing their success to find the high-converting keywords that fuel their sales. By understanding which terms drive their traffic, you can intercept their customers, identify underserved niches, and uncover new pockets of demand.

Reverse ASIN Lookups: The Ultimate Shortcut

The fastest way into a competitor's playbook is a Reverse ASIN lookup. You take a competitor's ASIN, plug it into a specialized tool, and get a list of the keywords they rank for—both organically and via ads.

This provides a blueprint of their keyword strategy. You see which terms they're betting their ad budget on and which ones bring them steady organic traffic. This is gold for building out your own master keyword list with terms that have already proven commercial intent in your market.

Platforms like Helium 10, Jungle Scout, and ZonGuru are built for this analysis. Helium 10’s Cerebro tool is famous for its Reverse ASIN capabilities, allowing you to get incredibly precise with your Amazon SEO.

Here’s a look at Helium 10's Cerebro tool in action. A single lookup can reveal thousands of keywords a competitor is ranking for.

The power here isn’t just the volume of keywords; it’s the ability to filter that data by search volume, organic rank, and competing products to zero in on valuable opportunities.

From Raw Data to Actionable Gaps

A raw export of 10,000 competitor keywords is noise. The magic happens when you filter this data to find strategic gold—high-opportunity terms your competitors are undervaluing or ignoring.

Here’s a practical workflow for finding these gaps:

- Filter for Relevance: First, eliminate anything not directly relevant to your product. If you sell a premium "stainless steel travel mug" and a competitor also sells a "plastic tumbler," filter out all plastic-related keywords.

- Identify "Striking Distance" Keywords: Look for keywords where a competitor ranks organically between positions 5 and 20. They have traction but aren't dominant. A well-funded PPC campaign can often steal the top spot and hijack that traffic.

- Find Low-Competition, High-Volume Terms: Hunt for keywords with healthy search volume (e.g., over 500 searches/month) but a relatively low number of competing products. These are often underserved niches where you can establish leadership faster.

- Look for Unoptimized Keywords: See a keyword in their PPC campaigns that's missing from their title or bullets? That's a massive opportunity. They're paying for traffic they could be getting organically. Swoop in, optimize your listing for that term, and build a more efficient sales engine.

This process turns a messy data dump into a prioritized list of offensive targets. For more ways to build out your core keyword list, check our guide on finding the most searched keywords on Amazon.

Your goal isn't to beat competitors at their own game—it's to change the rules. By finding the gaps they've overlooked, you build a more efficient, more profitable keyword strategy that's harder for them to counter. This is how you move from competing to leading.

Putting Your Keywords to the Test: Validation and Prioritization

You've compiled a massive list of potential keywords. That’s a start, but a long list is noise. The critical next step is to separate the high-impact winners from the budget-draining duds.

This is where we build a "Keyword Master List"—a single source of truth for both your organic and paid strategies. Instead of guessing, we'll use a clear framework to score and rank every term based on relevance, search volume, and, most importantly, its proven potential to convert.

Use PPC to Prove a Keyword's Worth

The single best way to know if a keyword is a winner is to make it prove itself. A low-budget "discovery" PPC campaign is the perfect testing ground. You're essentially forcing keywords to audition for a spot in your core strategy.

This data-driven validation removes guesswork. You stop hoping a keyword will work and start knowing it will, based on cold, hard performance data. It’s a performance-first approach that directly ties your research to sales.

The keywords you gathered from competitor research are perfect candidates for this validation stage.

This process gives you a solid list of terms to feed directly into your discovery campaigns, letting you test your competitors' top performers with your own products.

How to Structure Your Discovery Campaigns

The goal here isn't immediate profitability; it's learning. You want to gather performance data quickly and affordably.

Here’s a simple, effective setup:

- Create a dedicated Sponsored Products campaign. Keep test keywords separate to ensure their data isn't muddled with your evergreen campaigns.

- Use Broad and Phrase match types. This casts a wide net, revealing how real shoppers search and uncovering valuable long-tail variations you would have missed.

- Set a conservative daily budget. A budget of $15-$25 per day is typically sufficient to gather the initial data needed for decision-making.

- Let it run for 7-14 days. Be patient. You need enough time to collect meaningful data on clicks and conversions. Don't jump to conclusions after a day or two.

While the campaign is live, look beyond just sales. Pay close attention to Click-Through Rate (CTR) and Conversion Rate (CVR). A high CTR signals relevance, but a high CVR proves commercial intent—the metric that truly matters.

The Big Idea: Think of your discovery campaign as an intelligence-gathering mission. Every click is a data point. You're spending a little to learn a lot now, which will save you from wasting a ton of money later.

From Validation to a Prioritized Action Plan

Once your test period is over, dig into the Search Term Report to update your Keyword Master List.

Start by sorting your report by orders. Any search term that drove even one sale is a proven winner. These keywords have earned their promotion into your core campaigns.

This data-first approach is no longer optional. Modern Amazon keyword research is about understanding shopper behavior in real time, and metrics like CVR are the ultimate truth-tellers.

To objectively score and prioritize these terms, use a simple scorecard. This brings all key data points together, making it easy to see where to focus.

Keyword Prioritization Scorecard

| Keyword | Relevance Score (1-10) | Est. Monthly Search Volume | PPC Validation CVR (%) | Strategic Importance | Final Priority Score |

|---|---|---|---|---|---|

| ergonomic office chair | 9 | 150,000 | 14.5% | High (Core Product) | 95 |

| lumbar support desk chair | 8 | 45,000 | 12.0% | High (Core Feature) | 88 |

| comfortable computer chair | 7 | 85,000 | 11.2% | Medium (Broad Term) | 75 |

| gaming chair with footrest | 4 | 25,000 | 9.8% | Low (Adjacent Niche) | 42 |

Assigning a score creates a clear hierarchy. Keywords with the highest scores are top priorities for both aggressive PPC campaigns and deep integration into your product listing's title, bullets, and backend fields.

Move your top performers into their own dedicated Exact match campaigns for maximum control. For terms that got clicks but no sales, if they seem highly relevant, give them more time. If they're a poor fit, add them as negative keywords to stop wasting spend.

To build a complete system for monitoring these keywords long-term, our guide on using an Amazon keyword tracker offers a step-by-step process. This continuous loop—discover, test, analyze, and promote—is the engine that powers a truly unstoppable Amazon keyword strategy.

Putting Your Keywords to Work for Organic and Paid Growth

You’ve built a master list of validated keywords. Now it's time to turn that research into revenue. How you deploy your keywords is what separates brands that merely exist from those that dominate their categories.

This creates a powerful flywheel: your paid ads generate data and sales, which boosts your organic rankings. As organic visibility climbs, you become less reliant on ad spend, improving overall profitability. It's a rinse-and-repeat system for turning smart research into sustainable scale.

Weaving Keywords into Your Organic Listing

Your product listing must speak to both Amazon's A9 algorithm and human shoppers. The goal is strategic placement, not keyword stuffing.

Here’s a blueprint for placing keywords for maximum impact:

Product Title (Highest Impact): This is your prime real estate. Your absolute top, highest-intent keyword phrase must be here, ideally at the beginning. The title carries the most weight for ranking. Use "insulated coffee travel mug leakproof" instead of just "travel mug."

Bullet Points (Secondary Impact): Weave your next five most important keyword phrases into your bullet points. Lead each bullet with a benefit, then naturally incorporate the keyword. For example: "Spill-Proof Confidence: Our leakproof lid design means you can toss this stainless steel commuter mug in your bag without a second thought."

Backend Search Terms (Hidden Power): Use this section for keywords you couldn't fit into your main copy. Think synonyms ("thermos"), common misspellings, and valuable long-tail variations. Dive deeper into these by learning about Amazon long-tail keywords in our detailed guide.

Product Description & A+ Content: Your remaining relevant keywords can be used here. While they have less direct ranking influence, Amazon still indexes this text, and it's critical for answering customer questions and closing the sale.

Your listing isn't a "set it and forget it" document. Treat it like a living asset. If your PPC data uncovers a new high-converting phrase, get it into your listing immediately.

Structuring PPC Campaigns for Maximum Profit

A disorganized campaign structure burns through budget. A segmented, methodical approach gives you precise control over spend, bidding, and return on ad spend (ROAS).

Structuring campaigns by intent and match type works best:

- Brand Defense: Target your own brand name on exact match. It's a low-cost, high-conversion strategy that blocks competitors from siphoning your customers.

- Competitor Conquesting: Target competitor ASINs and brand names to intercept their traffic and steal market share.

- Core Performers (Exact Match): This campaign is for your proven, high-converting "money" keywords. Since they're validated, you can bid more confidently and allocate a healthy budget.

- Growth Explorers (Phrase/Broad Match): Use this for secondary and broader terms to discover new, relevant search traffic. Monitor the Search Term Report to find new winners to graduate to your "Core Performers" campaign.

The Overlooked Key to Profitability: Negative Keywords

One of the most critical—and neglected—practices is building a robust negative keyword list. Every click on an irrelevant search term is wasted money that kills profitability.

Make it a weekly habit to review your Search Term Reports to find every term costing you money without generating sales. If you sell a premium "leather dog collar," terms like "cheap," "nylon," or "cat collar" are perfect candidates for your negative keyword list. This simple habit can instantly boost campaign profitability by 10-20% by plugging leaks in your ad budget and forcing ads to show only for the most qualified shoppers.

Turning Your Research into Real Revenue

Finding the right Amazon keywords isn't a one-time task; it’s a continuous, data-driven cycle. Your PPC campaigns are the single best tool you have for sharpening your entire organic keyword strategy.

This creates the flywheel: paid ads generate hard data, which you use to boost organic rankings. As your organic presence grows, your overall profitability climbs.

Graduate from basic tools that only provide search volume estimates. An effective workflow pulls directly from Amazon's own data—Search Query Performance and Sponsored Products reports—and layers it with smart competitor analysis. This process swaps guesswork for hard evidence, ensuring every dollar is spent on terms that convert.

Think of your paid campaigns as an R&D department, constantly gathering market intelligence. Your job is to listen to what that data is telling you and then apply those lessons everywhere, from your product titles to your A+ Content.

This performance-first approach is what separates the brands that just show up from the ones that dominate their categories. When you build a solid system for finding, testing, and deploying keywords, you create a repeatable engine for growth on Amazon. This is how you turn raw research into predictable revenue.

Got Questions? We've Got Answers

Let's tackle some of the most common questions about building a killer keyword strategy.

How Often Should I Be Looking for New Keywords?

Think of keyword research as an ongoing routine, not a one-and-done task. A deep, strategic refresh every quarter is essential to catch new trends, analyze new competitors, and adapt to market shifts.

However, the real work happens weekly. You must live in your Search Term Reports. This is where you'll find the exact phrases customers are using to buy your products and, just as importantly, spot irrelevant terms wasting ad spend to add to your negative keyword lists. This consistent tuning keeps your campaigns sharp and profitable.

Where’s the Single Most Important Place to Put My Main Keyword?

The product title. Full stop.

If you do nothing else, get this right. The title carries more weight with Amazon's A9 algorithm than any other part of your listing. Your most important, high-volume keyword needs to be at the beginning of the title, as far left as possible while still reading naturally. This one move provides the biggest boost in organic ranking potential.

Once the title is optimized, weave secondary keywords into the bullet points, backend search term fields, and the product description to build a robust keyword profile.

Should I Really Spend Money Bidding on My Own Brand Name?

Yes, almost always. It may feel counterintuitive to pay for clicks you believe you’d get for free, but it's a vital defensive play.

Bidding on your brand name blocks competitors from snagging the top ad spot when a shopper is looking specifically for you. It’s your customer and your traffic. Don't let a competitor steal them at the finish line.

Bidding on your own brand is typically a cheap, high-converting campaign. Think of it as low-cost insurance that protects your brand and captures the highest-intent traffic that belongs to you.

What’s a “Good” ACoS for My Campaigns?

There is no single magic number for ACoS (Advertising Cost of Sale). Your target ACoS is entirely dependent on your product's profit margin and your strategic goal for that specific campaign.

For a new product launch, a higher ACoS might be acceptable to drive initial sales and reviews. For a mature, best-selling product, your ACoS target should be much leaner.

A more insightful metric is TACOS (Total Advertising Cost of Sale), which measures your ad spend relative to your total sales (paid and organic). TACOS reveals the true impact of your ads on your overall business growth. Ultimately, your target ACoS should be whatever keeps that specific product profitable.

Ready to stop guessing and start building a keyword strategy that drives real revenue? Headline Marketing Agency uses a data-first approach, leveraging insights from Amazon's most powerful datasets to build and manage PPC campaigns that deliver profitable, sustainable growth. Schedule a free consultation with our Amazon experts today and discover how we turn research into revenue.

Wollen Sie Ihre Amazon PPC-Performance aufs nächste Level bringen?

Lassen Sie Ihre Amazon PPC-Kampagnen professionell analysieren und entdecken Sie neue Wachstumsmöglichkeiten.