How to Win with a Performance-First Amazon Competitors Analysis

Go beyond surface-level metrics with a performance-first Amazon competitors analysis. Learn to use PPC data and listing insights to drive profitable growth.

A proper Amazon competitors analysis is your primary lever for profitable growth. It's about systematically dissecting what other brands are doing—their ad spend, listing strategies, and market positioning—to find exploitable gaps. This isn't a passive research task; it’s an active intelligence operation designed to uncover their weaknesses and convert them into your market share.

Forget just glancing at prices. A performance-first analysis reveals the inefficiencies in their PPC campaigns and the disconnects in their product pages, giving you the data you need to outmaneuver them.

Your New Framework for Competitor Analysis

Let’s be direct: the old way of "analyzing" competitors on Amazon is obsolete. Simply reacting to the best-seller list and adjusting your prices is a defensive game that guarantees you'll always be a step behind. In a marketplace this saturated, a performance-first mindset is non-negotiable.

To build a sustainable brand, you must look past surface-level tactics and into the hard data that actually drives growth. This isn't a one-off project; it’s an ongoing intelligence mission.

From Reacting to Predicting

The strategic goal is to stop playing catch-up and start anticipating your competitors' next moves. The framework is simple: your competitors' performance data tells a story about their strengths, weaknesses, and priorities. Your job is to find the holes in that story. This means analyzing:

- PPC & Ad Spend: Where are they bidding aggressively but failing to convert? This often points to a fundamental misunderstanding of their target customer. For instance, Amazon's advertising revenue hit $12.7 billion in Q1 2024 alone, proving that ad spend is a massive lever. Wasted spend by competitors is your opportunity.

- Listing & Messaging Flaws: What are customers consistently complaining about in their reviews? This is a direct, actionable feedback loop on what the market truly wants.

- Market Share & Momentum: Who is genuinely gaining traction—not just getting clicks? Identifying emerging threats before they become dominant players is critical.

This performance-first approach turns their weaknesses into your most valuable opportunities for organic growth, profitability, and scale.

Understanding the Scale of the Battlefield

The sheer size of Amazon is precisely why a data-driven approach is the only path forward. In 2024, Amazon’s net sales revenue is on track to surpass $638 billion, with over 60% of all sales coming from third-party sellers. This is a hyper-competitive arena with over 310 million customers and 200 million Prime members. Guesswork doesn't work here; data-backed decisions win.

A proactive analysis framework doesn’t just help you compete; it helps you define the terms of competition. By focusing on performance data, you move from playing defense to strategically shaping your market position.

To get you started, here is a breakdown of the essential pillars for any effective Amazon competitor analysis.

Key Focus Areas for Amazon Competitor Analysis

| Analysis Pillar | Key Data Source | Strategic Goal |

|---|---|---|

| PPC & Advertising | Sponsored Ads Reports, Keyword Tools | Identify wasted ad spend and keyword gaps to exploit. |

| Product Listing | Customer Reviews, Q&A Section | Find unmet customer needs and messaging flaws to capitalize on. |

| Market Positioning | BSR, Category Trends, Pricing Data | Understand market share and pricing elasticity to inform strategy. |

This table is your starting point for building a repeatable process to gather and act on this intelligence.

This guide will provide the framework to do just that. We’ll show you how to leverage PPC data as an intelligence tool, deconstruct product listings, and interpret market signals to make smarter, more profitable decisions. For a broader overview, this resource on how to conduct competitive analysis that wins markets is an excellent primer. From here on, we'll focus on the specific Amazon tactics that turn this knowledge into profit.

Find Competitor Weaknesses in Your PPC Data

Your Amazon PPC campaigns are more than an advertising channel; they are a live intelligence-gathering operation. Every click, impression, and conversion—or lack thereof—tells you what’s happening on the digital shelf. This is where you conduct high-stakes corporate espionage, completely legally.

The goal isn't to outbid everyone. That’s a fast track to burning your budget with negative returns. The real strategy is to outsmart them by finding where their ad spend is leaky and inefficient. You're hunting for the gaps between the traffic they pay for and the sales they fail to close.

When you find these gaps, their wasted ad spend directly funds your market share growth.

Uncovering Inefficiencies in Search Term Reports

The Search Term Report is ground zero. It provides an unfiltered view of the exact phrases shoppers are using right before seeing an ad. Digging into this data reveals where competitors are spending money but failing to connect.

You're looking for two specific scenarios:

- High Impressions, Low Clicks: A competitor is bidding aggressively, but their main image or ad copy is falling flat. Their initial pitch isn't compelling enough to earn the click.

- High Clicks, Low Conversions: Even better. A competitor is paying for traffic, but their product page is failing to convert. The price might be wrong, reviews are poor, or their A+ content is ineffective. They paid to bring a qualified customer to the aisle; you swoop in and make the sale.

This data provides a roadmap, showing you precisely which keywords are ripe for conquest because the current leader is vulnerable. For a deeper dive, our guide on mastering Amazon search terms is an essential resource.

Analyzing Competitor Bidding Patterns

Beyond individual keywords, campaign data reveals competitors' broader habits. By tracking impression share and cost-per-click (CPC) over time, you can map out their entire playbook.

Watch for predictable spikes in spend. Do they get aggressive at the start of the month? Do they increase bids on weekends? Understanding their promotional calendar and budget cycles allows you to plan campaigns to either counter their moves or strike when they pull back.

For example, if a key rival always boosts their budget in the last week of the quarter, they're likely pushing to hit sales targets. That’s your signal. You could defend your position with a modest budget increase or pivot to less competitive, long-tail keywords where your budget is more efficient.

This isn't about mirroring their moves. It's about identifying their patterns to make smarter, more profitable counter-moves. Your PPC data lets you read their playbook, giving you the power to write a better one.

Turning Their Wasted Spend Into Your Market Share

Once you've pinpointed these weaknesses, act with surgical precision. Don't just carpet-bomb the same keywords with more money; laser-target the customers your competitors couldn't convince.

Here’s your action plan:

- Isolate High-Opportunity Keywords: Create a target list of search terms where a top competitor is visible, but you have a superior offer (e.g., better reviews, price, or a clearer value proposition).

- Launch Targeted Campaigns: Build specific Sponsored Products campaigns for these terms. Do not dump them into a broad, automated campaign.

- Craft Compelling Ad Creative: Your ad's main image and headline must directly address the weakness you found. If their listing is confusing, your headline must be crystal clear. If their reviews cite a specific flaw, your ad must highlight how your product solves it.

This approach transforms your competitor analysis from a passive report into an active offensive strategy. By capturing the traffic they paid for but failed to convert, you grow sales and boost organic rank—all funded by their inefficiency.

Deconstruct Competitor Listings for Strategic Gains

A competitor's product page is their entire playbook, laid bare for you to analyze. It's the culmination of their product research, keyword targeting, and customer insights. To conduct a proper Amazon competitor analysis, you must stop viewing these listings as a customer and start dissecting them as a strategist.

Every element—the title, bullet points, images, A+ Content—is a breadcrumb. Following these trails reveals their perceived value propositions, their keyword strategy, and, most importantly, the glaring holes in their execution.

This isn't an academic exercise. By systematically breaking down their strengths and weaknesses, you can engineer a more compelling listing that speaks directly to their dissatisfied customers and captures their business.

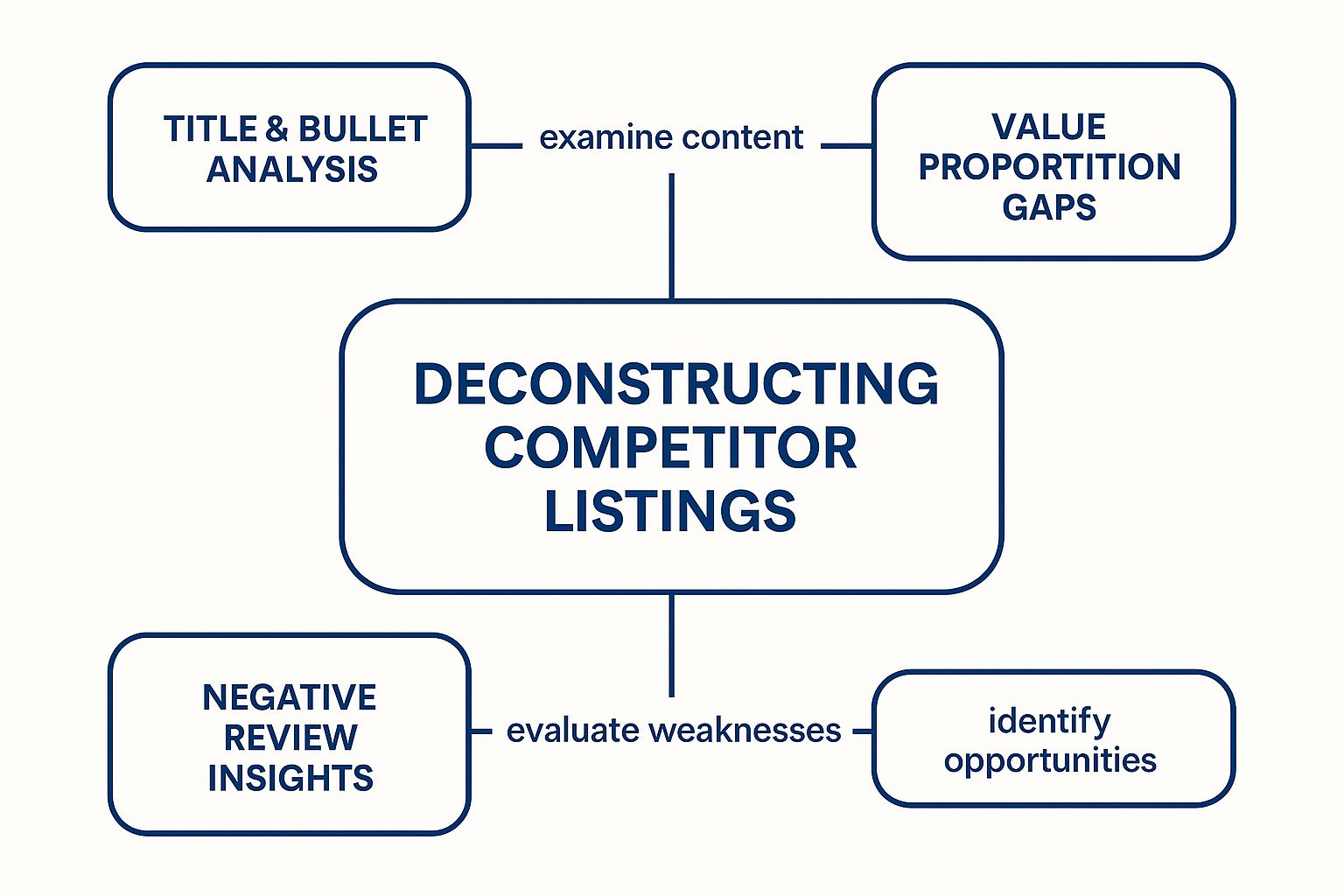

This map breaks down how to dissect competitor listings into three core pillars.

The real insight comes from connecting their front-end messaging (titles, bullets) with the unfiltered feedback buried in their negative reviews. That's where you expose the gap between their promise and their delivery.

Pinpoint Their Core Value Proposition

First, analyze the most valuable real estate on the page: the title and the first few bullet points. This is their elevator pitch. What benefit are they leading with? Speed? Durability? Luxury? Price?

- Keyword Choices: Note the primary keywords in the title. These are the terms they've identified as most critical for discovery.

- Benefit-Driven Language: How are they framing their bullet points? Are they listing dry specs ("5000mAh battery") or selling the outcome ("All-Day Power for Work and Play")? A spec-heavy listing often indicates a lazy, unfocused messaging strategy.

This scan provides a baseline of their intended positioning. Now, determine if it’s actually working.

Hunt for Gaps in Negative Reviews

Your competitor's one- and two-star reviews are pure gold—unfiltered market research, served on a platter. This is where you find the painful disconnect between the product they promised and the one customers received.

Ignore generic complaints and look for patterns. Is there a recurring design flaw? Is the product consistently smaller than expected? Does a key feature repeatedly fail? A recent study found that 84% of consumers trust online reviews as much as personal recommendations, making this data incredibly potent.

Treat negative reviews like a free focus group. Customers are explicitly telling your competitor what’s wrong. If they aren’t listening, you must.

These insights are your roadmap for product development and marketing. If a rival's best-selling office chair gets endless complaints about flimsy armrests, your listing must emphasize your reinforced, ultra-durable armrests. You're not just selling a chair; you're selling the solution to a known, frustrating problem.

Assess Their Visual Merchandising

On Amazon, images and videos do the heavy lifting. How effectively are competitors using them to tell a story and answer questions pre-emptively? Weak visual merchandising is a massive opportunity.

- Image Quality and Variety: Are their photos high-resolution? Do they show the product from all angles, in use, and next to common objects for scale? Many brands neglect lifestyle images, which are critical for helping customers visualize the product in their own lives.

- Informational Graphics: Are they using simple infographics to clarify features or dimensions? This is an easy win to reduce confusion and pre-empt negative reviews related to size or setup.

- Video Content: A product video is a powerful conversion tool. If your competitor lacks one, you have an immediate advantage. If they have one, critique it. Is it a boring 360-degree spin, or does it show the product solving a real problem for a real person?

By identifying their visual shortcomings, you can create a superior experience that builds trust and drives conversion. A polished visual strategy can make your product feel more premium and reliable, even at the same price point. For more on this, our complete guide to Amazon listing optimisation will show you where to focus for maximum impact.

Map the Competitive Landscape Beyond Your Niche

Deep in the Amazon trenches, it's easy to get tunnel vision. A truly strategic Amazon competitors analysis, however, requires looking beyond the usual suspects in your immediate category. The greatest long-term threat may not be the brand one spot above you in search results, but a retail giant or an international seller making a quiet, calculated push into your market.

Focusing only on direct, ASIN-level competitors is a tactical error. It traps you in reactive price wars while you miss the larger market shifts that will define your brand's future. You must zoom out.

This means identifying both direct and indirect challengers—anyone competing for the same customer dollars, even with a different product.

Identify Your True Competitors

First, broaden your definition of a competitor. It’s not just who sells a similar product; it’s who is winning market share. Break down the analysis into distinct tiers.

- Direct Competitors: Brands you already know, selling nearly identical products to the same audience on Amazon.

- Indirect Competitors: Brands solving the same customer problem with a different solution (e.g., high-end espresso machines vs. premium single-serve coffee pods).

- Emerging Threats: New sellers, particularly from international markets, who can gain ground rapidly with aggressive pricing or novel product features.

- Retail Giants: Don't ignore big-box stores. Retailers like Walmart and Target are pouring resources into their e-commerce platforms, making them a serious threat to Amazon-native brands.

For a deeper look into this research, our guide on the essential Amazon product research tools provides context on how to identify these players.

Look Beyond Amazon for Market Intelligence

To understand the entire battlefield, you have to get off Amazon. Market intelligence platforms that track sales data across multiple retail channels are invaluable. They show you who is genuinely capturing consumer spending, not just who has the best Amazon search rank this week.

This wider view is critical. Looking to 2025, Amazon faces intensified competition. While Walmart remains its primary U.S. rival, emerging platforms like Rakuten, specialized retailers like Newegg, and global powerhouses like Alibaba are all chipping away at market share. Each targets a slightly different customer, underscoring the diversity of the competitive landscape.

Using multi-channel data prevents you from overreacting to a small competitor’s temporary BSR spike while completely missing the steady market share growth of a larger, more strategic threat.

Your goal isn't just to know who your competitors are today. It's to anticipate who they will be tomorrow. A wider analysis is the only way to build a defensive moat that protects your brand from unforeseen challenges.

Beyond products, a key part of mapping the landscape is understanding brand visibility. A great way to quantify this is to learn How to Calculate Share of Voice. This metric measures your brand awareness against the entire field, not just direct rivals, providing a true benchmark of your market presence.

Grasping this wider ecosystem is essential for long-term planning. It informs everything from your product roadmap to pricing and market expansion. When you map the entire landscape, you position your brand to not only defend its turf but to proactively capture new territory.

Turning Competitive Insights Into Profitable Action

Data is just noise until it informs a decision. The entire purpose of your Amazon competitor analysis is to generate a prioritized list of smart, profitable actions you can execute now. Finding PPC gaps or listing weaknesses is the setup—turning those discoveries into a growth plan is the payoff.

Without a clear path from insight to action, your analysis is an academic exercise that burns time and budget. The goal is a repeatable process where battlefield data immediately informs ground-level strategy.

This means every finding is translated into a specific, measurable task. Discovered a competitor gets high traffic for a core keyword but fails to convert? That’s your cue to launch a laser-focused PPC campaign with a superior offer.

A Framework for Prioritizing Opportunities

Not all opportunities are created equal. Some offer massive potential but require significant investment; others are quick wins. You need a simple framework to prioritize.

The Impact vs. Effort matrix is perfect for this:

- High Impact, Low Effort: Execute immediately. This is low-hanging fruit, like rewriting your title to target a pain point mentioned in competitor reviews.

- High Impact, High Effort: These are your strategic projects. This could be launching a new product variation to fill a market gap or running a large-scale DSP campaign to steal market share.

- Low Impact, Low Effort: "Nice-to-have" tweaks. Address them when time permits, but don't let them distract from bigger goals.

- Low Impact, High Effort: Ignore these. They are resource drains with negligible upside.

This framework forces disciplined execution, ensuring your team’s energy is always focused on actions that create tangible value.

From PPC Insights to Campaign Adjustments

Advertising data provides the most immediate levers for action. Once you’ve pinpointed a competitor's weakness—like over-reliance on a single broad match keyword—you can exploit it.

For instance, if their PPC report shows sky-high impressions but a poor click-through rate on "eco-friendly yoga mat," it’s a clear signal their ad creative isn't connecting. Your action plan: launch a Sponsored Brands campaign for that exact term, leading with an image and headline that screams "sustainability." You intercept their unqualified traffic and convert it with superior messaging.

This is about being more relevant, not just outbidding them. In a market this tight, precision is everything. As of Q2 2025, Amazon holds a 23.74% share of the U.S. e-commerce market, with Walmart close behind at 23.39%. Winning on the margins is critical, and turning competitor data into precise ad adjustments is how it’s done. You can learn more about how these e-commerce giants compete for market share on Brand24.com.

Your ultimate goal is a continuous feedback loop. PPC data reveals an opportunity, you adjust campaigns to exploit it, and new performance data feeds your next analysis. This is how you build a dominant, self-improving advertising machine.

To make this process concrete, organize your findings and planned responses in a clear table. This transforms observations into a strategic roadmap.

Action Plan from Competitor Insights

| Insight Gained | Corresponding Action | Primary Metric to Track |

|---|---|---|

| Competitor A has low ratings due to "poor durability" comments. | Launch a social media campaign highlighting our product's lifetime warranty and superior materials. | Ad Click-Through Rate (CTR), Conversion Rate (CVR) |

| Competitor B is bidding on our brand name but has a weaker offer (no free shipping). | Create a defensive Sponsored Brands campaign on our own brand terms, emphasizing "Free & Fast Prime Shipping" in the headline. | Impression Share, Cost-Per-Click (CPC) |

| A new competitor is gaining traction with a feature we don't have (e.g., a travel-size version). | Add a "New Product Idea" to our R&D roadmap and survey existing customers about their interest in a travel-size option. | Survey Response Rate, Pre-order Interest |

| Top competitor's main image is cluttered and doesn't show the product in use. | A/B test a new main image for our product that features a clean, lifestyle shot showing the product in a real-world setting. | Session Percentage, Unit Session Percentage |

This framework isn't just for record-keeping; it's about accountability. It ensures every piece of intelligence leads directly to a test, a change, or a strategic decision.

Building a Data-Informed Product Roadmap

Ultimately, the most powerful actions inspired by your analysis are those that shape your long-term product strategy. Consistently seeing customer complaints about a rival's product durability isn't just a marketing opportunity—it’s a clear signal for your product development team.

Use this data to build a product roadmap that solves existing market problems. By creating a product that systematically addresses the documented flaws of current best-sellers, you launch with an immense competitive advantage.

Your product is no longer just another option; it’s the solution the market has been waiting for. This is how a simple Amazon competitor analysis evolves from a marketing task into a core driver of business innovation.

Even with a solid plan, analyzing Amazon competitors raises critical questions. As a brand leader, you need no-nonsense answers to make decisions that impact the bottom line.

Let's cut through the noise and address the most common questions we get.

How Often Should I Really Be Doing This?

The simple answer is "continuously," but that isn't actionable. A better approach is a two-track system.

Implement a weekly tactical check-in. This isn't a deep dive; it's a pulse check on your main rivals. Have they launched a new promotion? Changed their main image? Dropped their price? This is about spotting and reacting to immediate threats and opportunities.

Then, conduct a full, deep-dive analysis quarterly. This is where you dissect their PPC performance, deconstruct their listings, and analyze broader market shifts. This cadence typically aligns with your own business planning cycles, allowing the insights to directly influence your budget, product roadmap, and strategy for the next 90 days.

This approach maintains agility without getting lost in the weeds.

What Are the Best Tools for Spying on Competitors?

Manual tracking is slow, inefficient, and prone to error. To do this right, you need a smart combination of Amazon's first-party data and key third-party tools.

- Amazon’s Search Query Performance Dashboard: This is your ground truth. It provides a goldmine of data straight from Amazon, showing precisely where you and your competitors rank for the most important keywords, with hard numbers on impression share, clicks, and conversions. Using this is non-negotiable.

- Market Intelligence Platforms: Tools like Helium 10 or Jungle Scout are excellent for filling in the gaps. They help estimate a competitor's sales volume, track keyword ranking changes over time, and provide a better sense of overall category health.

- PPC Management Software: Many advanced PPC platforms have built-in competitive intelligence features. These can uncover what your rivals are bidding on, their estimated ad spend, and the keywords they're targeting. This is how you transform your ad campaigns from a sales driver into an intelligence-gathering machine.

The goal isn't to have the most tool subscriptions. It's to combine Amazon's direct data with insights from third-party tools to create one clear, complete picture of the battlefield.

How Do I Handle Competitor Analysis in Different Countries?

Global expansion adds complexity, but the fundamentals remain the same. The biggest mistake is assuming a strategy that works in your home country will translate elsewhere.

First, treat each marketplace as a separate project. Shopper behavior, price sensitivity, and search terminology can vary dramatically between countries. A compelling value proposition in the U.S. might completely miss the mark in Germany or Japan.

Next, identify the "local heroes." Your biggest competitor in a new market is likely a brand you've never heard of. Use the local Amazon site and market intelligence tools to spot these regional players. Then, deconstruct their strategy from the ground up, paying close attention to their listing language (including local slang), image style, and how they handle customer reviews in that language.

Finally, adapt your PPC strategy. Do not simply translate your keyword list. Conduct fresh research to understand what local customers are actually searching for. Ad costs and bidding strategies will also differ. Start with a small test budget to gather baseline data before scaling.

A robust Amazon competitor analysis isn't a research project; it's the foundation of a proactive, profitable growth strategy. When you convert market data into decisive action, you stop playing catch-up and start setting the pace. At Headline Marketing Agency, we specialize in turning these insights into sustained market dominance through data-driven PPC and DSP strategies that deliver profitability and scale.

Ready to turn your competitors' weaknesses into your greatest strengths? Learn how Headline can build your winning Amazon strategy.

Wollen Sie Ihre Amazon PPC-Performance aufs nächste Level bringen?

Lassen Sie Ihre Amazon PPC-Kampagnen professionell analysieren und entdecken Sie neue Wachstumsmöglichkeiten.