PPC Amazon Software: Your Lever for Organic Growth and Profitability

Discover how ppc amazon software can boost profitability with data-driven campaigns. A concise guide for senior eCommerce leaders.

For established brands, PPC Amazon software isn't just another automation tool—it's the strategic command center for winning on the digital shelf. This guide cuts through the noise to provide a performance-first framework, demonstrating how the right technology connects every ad dollar to organic rank, true profitability, and sustainable scale.

Why Top-Tier PPC Software Is More Than Just Automation

Let's be direct: for any brand serious about scale, manual Amazon PPC management is a losing proposition. The marketplace is too competitive, the data too vast, and the financial stakes too high to operate on instinct. Relying on Seller Central's native tools is like navigating with a paper map in the age of GPS—you're functionally blind to the fastest, most profitable routes.

This is where sophisticated PPC Amazon software provides a decisive advantage. It transcends simple task automation to deliver the intelligence required for smarter, faster decision-making. Think of it less as a robot executing rules and more as an expert co-pilot, continuously analyzing thousands of data points to chart the optimal path to growth.

The Critical Shift from ACoS Fixation to Profit-Driven Strategy

For too long, the default PPC metric has been Advertising Cost of Sale (ACoS). While a useful indicator, an obsessive focus on minimizing ACoS is a strategic trap. Chasing an ultra-low ACoS often means sacrificing spend on keywords that are critical for building organic rank and defending market share. The best software forces a shift toward a more holistic view of performance.

Modern PPC platforms enable brands to optimize for Total Advertising Cost of Sale (TACoS) and, more critically, real-time, SKU-level profitability. They illuminate the direct link between ad spend and the entire Amazon P&L, proving how paid media directly lifts organic sales volume.

This strategic pivot is a game-changer. It re-frames advertising from a cost center into a direct investment in the brand's long-term enterprise value. Suddenly, you're asking much more impactful questions:

- Which keywords justify a higher ACoS because they protect our top organic positions?

- How is our ad investment in a new product accelerating its climb to page one?

- Where is budget being wasted on inefficient bids or untapped keyword opportunities?

There's a reason Amazon advertising is a multi-billion dollar arena: it delivers results. The average conversion rate on Amazon is a staggering 9.96%—roughly seven times the typical e-commerce rate of 1.33%. With stakes this high, leveraging the right technology to execute your ad strategy is what separates category survivors from category leaders. You can discover more insights about PPC statistics that should inform your approach.

What Defines a Winning PPC Platform?

Not all Amazon PPC software is created equal. While many tools can automate basic tasks, elite platforms function as a mission control center for your entire retail media operation. For an e-commerce leader, the distinction is profound—it's not about saving a few hours of manual work; it's about securing a tangible competitive advantage that drives bottom-line growth.

The objective is to move beyond surface-level metrics. A great platform doesn't just chase a lower ACoS; it engineers profitable growth. It connects ad spend to total business health, showing precisely how paid campaigns amplify organic sales and fortify the brand's position on Amazon.

AI-Powered Bid and Keyword Intelligence

At the core of any top-tier software is an AI that doesn't just automate bids—it makes them strategically intelligent. This isn't about simple "if-then" rules. It's a sophisticated engine processing thousands of data points in real-time—competitor bids, time of day, conversion history, inventory levels—to place the optimal bid at the precise moment of opportunity.

This level of intelligence uncovers profitable niches a human analyst would miss. For example, the AI might identify a long-tail keyword that converts exceptionally well only on weekend mornings and dynamically adjust bids to dominate that specific traffic. This granular control ensures every ad dollar is maximized, whether the objective is a product launch or defending a best-seller's rank.

One of the most powerful capabilities of advanced PPC software is predictive forecasting. It can model the likely outcomes of budget increases or strategic shifts, enabling decisions based on data-driven projections instead of costly experimentation.

Advanced Analytics and Business Strategy

The true power of premier Amazon PPC software lies in its ability to translate raw campaign data into actionable business intelligence. While Seller Central provides the basics, advanced platforms offer a deeply integrated view of performance, finally revealing the symbiotic relationship between paid advertising and organic sales.

These tools are built to answer the questions that matter most to leadership:

- What's our true profitability? They calculate SKU-level net profit after factoring in ad spend, all Amazon fees, and COGS.

- Which keywords are fueling organic rank? The software tracks how paid conversions on specific keywords directly improve organic search position over time.

- Where are we losing to competitors? It delivers share-of-voice (SOV) reports, pinpointing where you're gaining or losing ground on critical search terms.

This caliber of analysis transforms PPC from a marketing tactic into a core driver of the enterprise growth engine. For a deeper dive into these strategic components, see our guide on Amazon PPC management software.

Critical PPC Software Feature Evaluation

When evaluating platforms, it's crucial to distinguish between "must-haves" and "nice-to-haves." For enterprise brands, certain features aren't conveniences; they are fundamental to scaling profitably and outmaneuvering the competition. Lacking a core capability means leaving significant revenue and market share on the table.

This table breaks down the features you absolutely need versus those that are supplemental.

| Feature Tier | Core Capability | Business Impact for Enterprise Brands | Red Flag (If Missing) |

|---|---|---|---|

| Must-Have | AI-Powered Bid & Keyword Automation | Maximizes ROI by adjusting bids 24/7 based on real-time data, preventing wasted spend and capturing hidden opportunities. | Manual bidding can't compete; you'll overspend and miss out on profitable placements. |

| Must-Have | SKU-Level Profitability Tracking | Provides a true understanding of performance by connecting ad spend to net profit, not just revenue or ACoS. | You're flying blind, potentially spending heavily on ads for unprofitable products. |

| Must-Have | Amazon Marketing Cloud (AMC) Integration | Unlocks deep customer path-to-purchase insights and advanced attribution modeling for a complete view of the sales funnel. | Your strategy is limited to last-touch attribution, missing the full impact of your upper-funnel ads. |

| Nice-to-Have | Cross-Channel Retail Media Dashboards | Offers a single view of performance across Amazon, Walmart, Instacart, etc., for a holistic retail media strategy. | It’s a huge time-saver, but data can be consolidated manually if necessary. |

| Nice-to-Have | Competitor SOV & Market Intel | Tracks your share of voice on key terms against competitors, providing insights into market positioning. | Useful for strategic planning, but core performance optimization is the first priority. |

Ultimately, your software should be a strategic partner. It must provide the foundational data and automation required to compete effectively while also delivering the deeper insights that fuel long-term, profitable growth.

Unified Retail Media and AMC Integration

Today’s consumer journey is fragmented across platforms, and your advertising strategy must reflect that reality. Leading brands require a unified view of ad performance across major retailers, including Walmart Connect, Instacart Ads, and Target's Roundel. Top-tier PPC software platforms aggregate this data into a single dashboard, enabling holistic management, optimization, and reporting. This breaks down data silos and provides a complete picture of your customer's path to purchase.

Even more critical for enterprise brands is integration with Amazon Marketing Cloud (AMC). AMC is a secure data "clean room" where brands can analyze highly detailed, anonymized signals from Amazon Ads alongside their own first-party data. When your software integrates with AMC, you can map the entire customer journey, finally understanding how shoppers interact with your Sponsored Display, Sponsored Brands, and DSP campaigns on their way to a purchase.

This is the capability that separates market leaders from the rest of the pack. The global PPC software market is projected to hit $36.36 billion by 2029, driven by the need to manage complexity and unearth deeper insights. Enterprise tools often deliver a 450% ROI improvement in the first year by using AI to uncover hundreds of new, profitable keywords—a massive advantage when the average Amazon shopper sees over 60,000 ad impressions daily. Investing in a platform with these advanced features isn't an expense; it's a direct investment in a smarter, more profitable future.

How PPC Investment Fuels Your Organic Growth Flywheel

The most sophisticated brands on Amazon understand a fundamental truth: PPC isn't just about generating a sale today. It's about strategically investing in more profitable, organic sales tomorrow. This is the "flywheel effect," the engine that separates market leaders from the competition. It’s a methodology for turning paid advertising into a self-sustaining growth machine.

Imagine spinning a massive, heavy flywheel. The initial pushes require immense effort—that's your ad spend. But with each consistent push, the wheel gains momentum. Soon, it's spinning with its own inertia, requiring only minimal effort to maintain its speed. Your PPC campaigns are those critical, strategic pushes.

Viewed through this lens, advertising ceases to be a simple cost of goods sold and becomes your most potent growth lever. The right Amazon PPC software ensures every dollar you invest is a powerful, efficient push that gets your flywheel spinning faster than your competitors'.

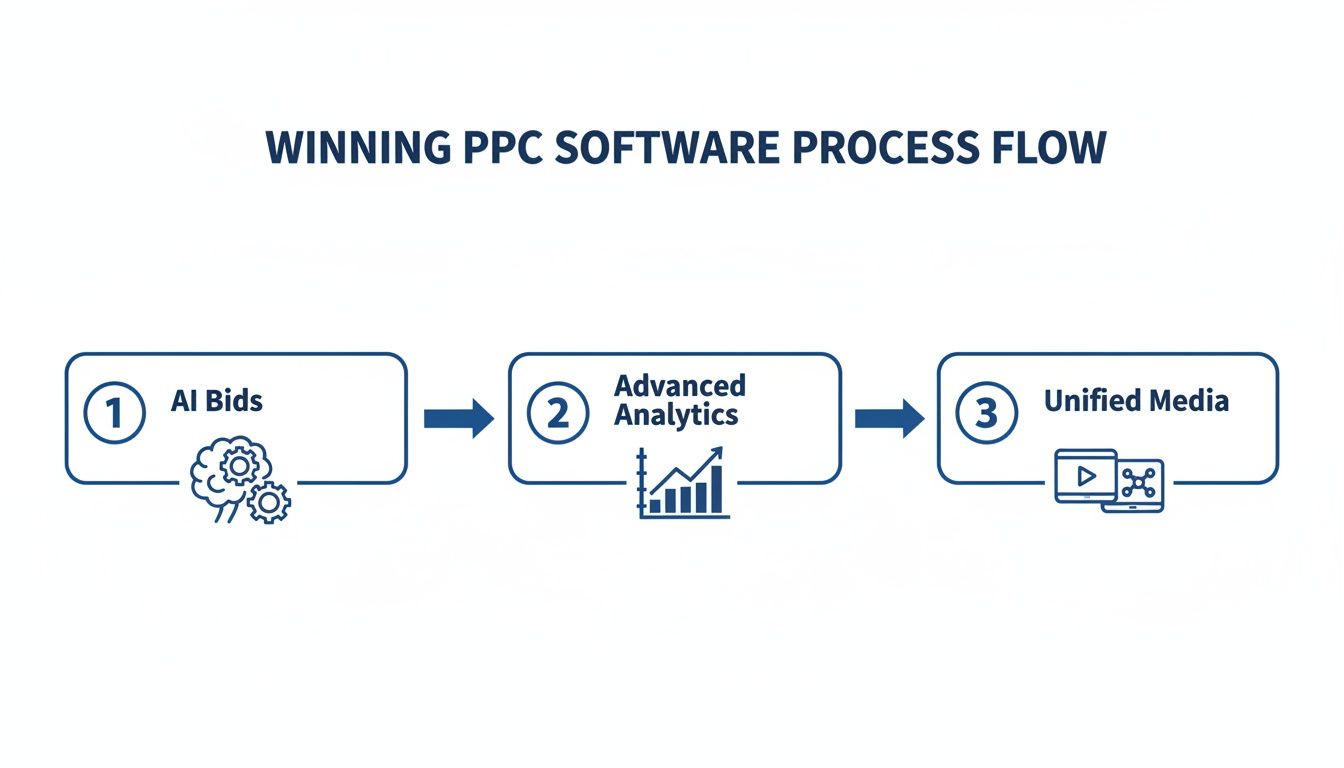

The process below illustrates how a software-driven strategy integrates AI-powered bidding and deep analytics into a unified plan for sustainable growth.

This is not a set of disconnected tactics. A winning PPC program is an interconnected system where each component strengthens the others, creating a cycle of compounding performance.

The Four Stages of the Flywheel

The flywheel isn't magic; it's a logical, four-stage sequence. When executed correctly, each stage feeds the next, allowing your initial advertising investment to compound over time.

Paid Traffic Drives Initial Sales and Data: It begins with a sponsored click. A shopper sees your Sponsored Products ad, clicks, and makes a purchase. That single transaction does more than generate revenue; it sends a crucial signal to Amazon's A10 algorithm: "This product is highly relevant for this keyword."

Sales Velocity and Reviews Build Credibility: These initial paid sales build your product’s sales history, or sales velocity. Each purchase also creates an opportunity for social proof in the form of customer reviews. Strong sales velocity and positive reviews are two of the most heavily weighted factors in Amazon's organic ranking algorithm.

Improved Organic Ranking Increases Visibility: As your sales history and review count grow, the algorithm takes notice. It rewards your product with a higher organic ranking for the keywords driving conversions. Suddenly, you're appearing on page one without paying for the click. This is the first major return on your flywheel investment.

Organic Sales Drive Profitability and Reinforce Rank: This is where the cycle becomes self-sustaining. Shoppers discover your product organically and purchase it. These sales are significantly more profitable as they carry no direct advertising cost. This influx of organic sales further boosts your total sales velocity, which in turn solidifies—and often improves—your organic rank.

You've now created a virtuous cycle. Higher organic rank drives more profitable sales, which provides more capital to reinvest into PPC for new product launches or defending market share. A well-designed campaign structure is essential, which you can explore in our complete guide to Amazon PPC.

Protecting the Flywheel From Friction

As powerful as the growth flywheel is, it's not immune to friction. Anything that hinders conversion can slow it down or stop it completely. Negative reviews are the most potent source of friction, as they decimate conversion rates and signal to Amazon that your product provides a poor customer experience.

PPC can drive unlimited traffic, but if that traffic converts poorly due to bad reviews, the investment is wasted. Proactive reputation management, including managing and removing problematic Amazon reviews, isn't a secondary task; it's an essential discipline for protecting your momentum.

By maintaining brand reputation and ensuring product quality, you protect the flywheel you've worked hard to build. The objective is a seamless journey from ad click to purchase, reinforcing the positive signals you're sending to Amazon's algorithm. This is how you transition from simply buying traffic to building a brand that dominates the marketplace.

Software vs. Managed Service vs. Agency: Defining Your Operational Playbook

Once you graduate from Seller Central's basic tools, you face a critical strategic decision. The choice isn't merely about which tool to use; it's about defining your entire operational model for retail media. Who drives strategy? Who owns the data? And where does your advertising expertise reside?

There are three primary models: bringing the function in-house with software, using a hybrid managed service, or outsourcing to a traditional agency. There is no single "right" answer—only the one that aligns with your company's resources, objectives, and culture.

In-House with PPC Software

This is the path for brands committed to building a long-term, sustainable competitive advantage. You license a powerful PPC software platform, and your internal team manages the entire function—strategy, execution, and analysis.

This model is about building an internal center of excellence for Amazon advertising. All performance data, strategic insights, and lessons learned remain proprietary assets within your organization. You own the tech stack, you own the data, and you can pivot strategy instantly without external dependencies.

The in-house model is the ultimate power move for data ownership. You're not just running ads; you're building a proprietary asset of performance data and insights that no competitor can ever access or replicate.

However, this approach demands significant commitment. It requires hiring, training, and retaining talent with deep expertise in the Amazon ecosystem. The software provides the firepower, but your team must provide the strategic direction. It’s a high-investment, high-reward strategy best suited for larger brands dedicated to building a dominant in-house capability.

Managed Service by a Software Provider

This model offers a strategic middle ground. You gain access to a top-tier PPC software platform, but the software provider's own team of experts operates it on your behalf. It’s a hybrid approach that pairs best-in-class technology with dedicated human expertise.

This is an ideal solution for brands that need the power of a sophisticated platform but lack the specialized internal team (or the time to build one) to manage it effectively. You partner with experts who know their own software intimately, ensuring you extract maximum value from its features from day one.

The primary advantages are speed and expertise. You can launch a highly advanced advertising program quickly, bypassing a lengthy hiring and training cycle. The main trade-off is being one step removed from daily execution, which can make you slightly less agile than a fully dedicated in-house team. It's often the perfect fit for mid-market brands poised for rapid scaling.

Outsourcing to a Traditional Agency

The third option is the classic agency model. You engage an Amazon advertising agency, and they manage your campaigns using their own suite of tools and internal processes, providing periodic performance reports. This is the most hands-off option for your internal team.

An agency can be invaluable for brands with limited or no internal marketing resources. They provide immediate expertise and handle all aspects of campaign management. The primary drawback? The agency often operates as a "black box." You may have limited visibility into the specific software they use, and you do not own the campaign data or historical learnings if you choose to end the partnership.

This lack of data ownership is a significant long-term strategic risk. You are essentially renting expertise rather than building an internal asset. This model is most appropriate for brands that require a completely outsourced solution and are not focused on developing an internal advertising competency. Exploring various Amazon advertising management services can help clarify the different partnership offerings.

Operational Model Comparison: PPC Software vs. Managed Service vs. Agency

The optimal choice depends on your organization's unique DNA—your budget, team capabilities, and long-term ambitions for data ownership. This table breaks down the key differences to guide your decision.

| Criteria | In-House with Software | Managed Service (Software Provider) | Traditional Agency |

|---|---|---|---|

| Control | Maximum. Direct, real-time control over strategy and execution. | High. Strategic control, but daily execution is managed by the provider. | Low. Limited visibility and control; you guide the overall strategy. |

| Data Ownership | Full Ownership. All data and learnings are a permanent company asset. | Shared/Full. You typically own the data within the platform you license. | None. The agency owns the data and historical campaign information. |

| Expertise | Internal. Must hire and develop deep in-house expertise. | Hybrid. Access to platform experts and dedicated account managers. | External. You rent expertise from the agency's team. |

| Speed to Scale | Slow. Requires hiring, training, and a steep learning curve. | Fast. Quick onboarding with immediate access to expert management. | Fast. Can launch campaigns quickly by leveraging the agency's existing team. |

| Cost Structure | High fixed costs (salaries) + software license fees. Potentially lower total cost at scale. | Software license fee + management fee. Often a predictable, scalable cost. | Typically a percentage of ad spend or a flat retainer. Can be expensive. |

| Best For | Enterprise or large brands building a long-term competitive advantage. | Mid-market brands seeking rapid growth with expert guidance. | Brands with limited resources needing a hands-off, full-service solution. |

Ultimately, there is no universally "best" model. The right path is the one that aligns with your strategic goals, whether that's building an unbeatable in-house team or moving with maximum velocity alongside a trusted partner.

How Top Brands Win With Data-Driven PPC Software

Theory and features are one thing; real-world performance is another. How does PPC Amazon software deliver wins in a hyper-competitive market? Let's examine a real-world case study of how the right technology transformed a complex challenge into a significant business victory.

Consider a seller managing a portfolio of over 200 brands with an annual ad spend exceeding $120 million. During a market downturn, this business didn't just survive—it grew by an astounding 50%. This result wasn't luck. It was the outcome of a deliberate, data-first strategy executed at scale through intelligent software.

This case proves a critical point: winning on Amazon is not about outspending the competition. It's about out-thinking them by leveraging insights that Seller Central simply cannot provide. The best brands constantly analyze performance data; exploring diverse retail media use cases, for instance, can unlock new avenues for data-driven optimization.

From ACoS to Profit-Driven Bidding

When managing thousands of products and millions of keywords, complexity is the primary obstacle. Attempting to manage to a single, blended ACoS target across a diverse catalog is a guaranteed way to misallocate capital. The game-changing strategic shift was abandoning ACoS in favor of SKU-level profitability.

The software was the engine that enabled this pivot at scale. It integrated sales data, ad spend, and cost of goods to calculate the true net profit for every single product. This immediately revealed that products at different price points required vastly different bidding strategies to be profitable.

The platform's analysis uncovered a critical insight: 45% of total conversion value came from low-cost items under $25, which had a strong conversion rate of 12.50%. Conversely, high-ticket items over $100 drove 20% of the value but converted at a much lower 6.40%.

This is the type of data that fundamentally changes strategy. Without it, a manager might treat both product groups identically—overbidding on expensive items that convert poorly while underfunding the high-volume products that actually drive the business. Armed with this data, the seller implemented precise, profit-driven bid strategies for each product segment. You can see the full breakdown and learn more about their data-driven advertising success.

The Power of Granular Dayparting

The second strategic weapon was the software’s ability to analyze performance on an hourly basis, a tactic known as dayparting. For a catalog of this size, manual dayparting is impossible. The software’s AI, however, identified specific times of day when conversion rates for certain product categories peaked.

This enabled an automated, highly strategic approach to budget allocation throughout the day:

- Aggressive Morning Bids: For high-traffic consumer goods, the platform automatically increased bids during peak morning shopping hours to capture early-bird demand.

- Conservative Midday Spending: It then reduced bids during the quieter midday slump, preserving budget by avoiding low-intent clicks.

- Targeted Evening Push: As shopper activity increased in the evening, bids were ramped up again, particularly for higher-priced items that often involve more research prior to purchase.

This intelligent, automated budget pacing ensured that ad dollars were concentrated in the moments of highest conversion potential, dramatically improving ROI across the entire portfolio. This isn't just a success story; it's a blueprint for any brand looking to scale. The path to sustainable growth on Amazon is paved with data that makes every advertising dollar work more efficiently.

Building Your Performance-Driven PPC Program

Choosing the right Amazon PPC software is not a technical decision—it is a strategic one that will define your brand's trajectory on the marketplace. The choice is clear: do you want a tool that simply automates tasks, or do you want to build an in-house powerhouse that leverages data and technology to drive durable, long-term growth?

The objective is not merely to manage ad spend more efficiently. It is to secure a decisive competitive advantage.

This requires looking beyond surface-level metrics like ACoS to focus on what truly drives business value: profitability, market share, and the organic growth flywheel. The right software partner provides the deep analytics and intelligent automation necessary to transform your PPC program from a cost center into a powerful growth engine. It's about empowering your team to make smarter, data-backed decisions that compound over time.

The In-House Advantage

When you bring your advertising program in-house and power it with superior software, you commit to owning your brand's destiny on the platform. Instead of renting expertise from an agency, you build it as a core competency.

Every campaign insight, every piece of customer data, and every strategic win becomes a permanent, proprietary asset. This is how market leaders construct a competitive moat that is nearly impossible for competitors to breach.

This approach also fosters a culture of performance and accountability. Your team is directly connected to the results, leading to faster optimizations and a deeper understanding of how advertising impacts the entire business. It's about equipping your own people with the best tools to win on your terms.

Your Final Evaluation Checklist

As you evaluate software options, you must cut through the marketing jargon and focus on capabilities that deliver tangible results. Base your decision on a clear, performance-first checklist. Do not settle for a tool that just automates bids; demand a platform that provides true business intelligence.

Use this checklist to guide your decision-making process:

- Profitability Focus: Can the software track profitability at the SKU level, not just ACoS? You must have visibility into true net profit after all fees and ad spend.

- Flywheel Analytics: Does it clearly demonstrate the link between ad spend and organic rank? The platform must prove how your paid media is accelerating the growth flywheel.

- Data Ownership: Is the partnership structured for transparency? Ensure you have full ownership and access to all historical performance data, even if you switch providers.

- Strategic Insights: Does it offer advanced analytics like share-of-voice reporting and Amazon Marketing Cloud (AMC) integration? These are essential for making high-level strategic decisions.

Choosing your PPC software is the cornerstone of building a resilient, data-driven advertising program. Focus on platforms that offer more than just automation—they should give you a clear path to owning your data, mastering your market, and scaling profitably for the long haul.

The right choice will enable your team to evolve from reactive campaign managers into proactive business strategists, transforming your Amazon presence into an undeniable force in your category.

Frequently Asked Questions

Choosing the right PPC Amazon software is a significant decision, and it’s natural for senior leaders to have questions. Here are direct, no-nonsense answers to help guide your next steps.

When Is The Right Time To Invest In Paid Software?

You've reached the tipping point when manual management is no longer scalable, or when your strategy demands deeper data than Seller Central can provide. For a leader, the time to invest is when you need to definitively connect ad spend to overall profitability and organic growth.

If your team spends more time pulling reports than analyzing them, it's time. If you need to scale advertising without a linear increase in headcount, it's time. This is about transitioning from a reactive posture to proactively architecting growth based on reliable data.

What Is A Realistic ACoS To Target With New Software?

There is no single "right" ACoS. The appropriate target depends entirely on the strategic objective for a specific product. One of the most common and costly errors is managing to a single, blended ACoS target for an entire catalog. This approach hobbles both new launches and mature products.

For a new product launch, a high ACoS (even 50% or more) is not a loss; it is a strategic investment in visibility and sales velocity to build organic rank. For a mature, profitable hero product, the ACoS target should be much lower and directly tied to its profit margin. Effective software allows you to abandon the one-size-fits-all model and set intelligent, SKU-level ACoS targets for every item in your portfolio.

Can PPC Software Truly Replace An Agency?

Yes, but it requires a strategic commitment to building in-house expertise. The software provides the tools and data, but your team must supply the strategic thinking to drive results.

For large brands, this transition can be a game-changer. It puts your team in direct control, enabling more precise and agile execution. More importantly, it ensures you own your data—a critical long-term competitive advantage. Think of it less as "replacing" an agency and more as insourcing strategic control over a mission-critical business function. Your team evolves from campaign managers into true growth drivers.

Ready to turn your Amazon advertising into a predictable, profitable growth engine? Headline Marketing Agency combines expert strategy with powerful data to help brands dominate their categories. Schedule a free consultation today to see how we can build your performance-driven PPC program.

Ready to Transform Your Amazon PPC Performance?

Get a comprehensive audit of your Amazon PPC campaigns and discover untapped growth opportunities.