The Amazon Keyword Tracker Playbook: Fueling Organic Growth with PPC

Unlock how keyword tracker amazon data drives PPC wins and boosts organic rank with clear, actionable steps.

A high-performance Amazon keyword tracker is more than a rank report—it's the central nervous system for your Amazon growth engine. The most sophisticated brands don't use this data to chase vanity metrics; they use it to unearth profitable ad opportunities, diagnose listing issues before they kill sales velocity, and fundamentally link keyword performance to the P&L.

The goal is to stop asking, "Are we ranking?" and start asking, "Are we profitably dominating the keywords that matter?"

Rethinking Your Amazon Keyword Tracker

Too many eCommerce leaders treat their keyword tracker as a reactive tool—a report card to glance at. This is a massive missed opportunity. Your keyword data isn't a historical document; it’s a predictive map showing precisely where to allocate your next marketing dollar for maximum profitable return.

The real leverage emerges when you view your Pay-Per-Click (PPC) campaigns not just as a sales driver, but as a strategic lever for organic growth. Your keyword tracker is the fulcrum. When you master the interplay between ad spend, sponsored rank, organic rank, and sales velocity for a specific term, you can make surgical decisions that generate sustainable, profitable scale.

From Vanity Metrics to Profit Drivers

Let's move beyond the page-one-or-bust mentality. A performance-first approach means your keyword data must provide clear, actionable answers to critical business questions:

- Which keywords drive the most profitable conversions, not just revenue?

- Where is our PPC spend merely propping up a listing with a poor conversion rate?

- Which top-ranking organic keywords represent an opportunity to strategically reduce ad spend and improve Total Advertising Cost of Sale (TACOS)?

- Did we lose rank on a core term because a competitor launched an aggressive promotion, or because our own conversion rate is bleeding?

This shift in thinking transforms your keyword tracker from a passive dashboard into an active command center. For teams still defining their core search landscape, our guide on building a foundational Amazon keywords list is the essential starting point.

The PPC and Organic Flywheel

The "flywheel" isn't a buzzword; it's a measurable, data-backed system on Amazon. A successful PPC campaign for a target keyword drives sales. Amazon’s A9 algorithm interprets this sales velocity as a powerful signal of relevance, which in turn boosts your organic ranking for that same keyword. Higher organic rank drives more sales, and the cycle accelerates.

Your keyword tracker is the diagnostic tool for this flywheel. It reveals where the engine is firing efficiently and where it requires a tune-up—be it a bid adjustment, a listing optimization, or a pricing strategy shift.

One brand in the competitive supplements space used this flywheel to launch a new product. They invested heavily in "Top of Search" PPC for their primary keyword, "collagen peptides for women." Within three weeks, the sales velocity from ads pushed their organic rank from page four to the top 5. They then strategically scaled back PPC, allowing the now-strong organic rank to carry the sales load, achieving a 25% improvement in their launch TACOS. This integrated approach ensures every ad dollar is an investment in long-term organic real estate and market share.

Building Your Keyword Intelligence Engine

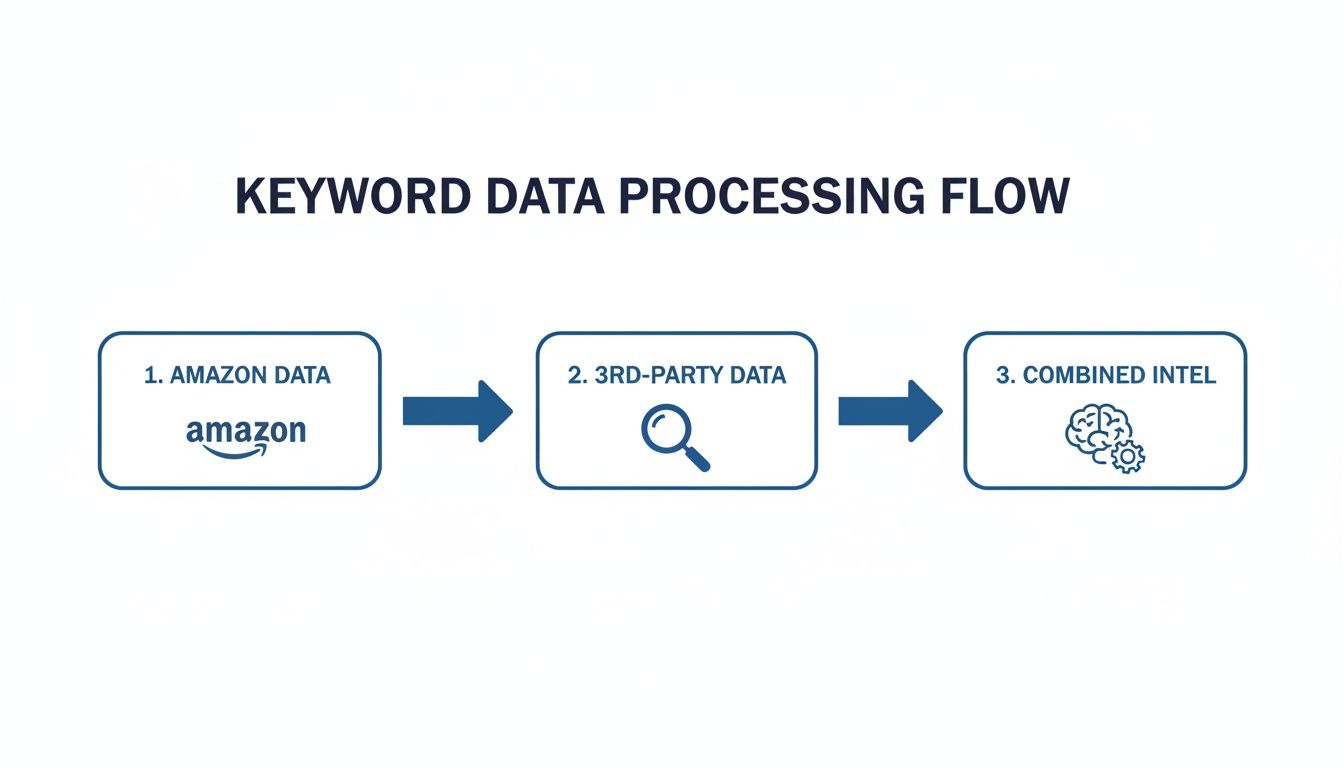

Your Amazon strategy is only as strong as the data fueling it. An effective Amazon keyword tracker isn't a single tool; it's an intelligence engine built by synthesizing multiple data sources. Relying on one stream of information is like navigating with an incomplete map—you'll miss critical turns and lucrative opportunities.

The most effective approach combines the ground truth of Amazon’s first-party data with the competitive context from third-party platforms. This blend provides a complete operational picture, enabling confident, data-backed decisions.

Combining First-Party and Third-Party Data

First-party data comes directly from Amazon and is the most accurate reflection of your brand's performance. The two primary sources are the Search Query Performance (SQP) report and Brand Analytics. SQP provides an unfiltered view of the exact terms customers use to find and purchase your products.

The limitation? This data only shows your slice of the market. It won't reveal the total search volume for a keyword you aren't yet ranking for or how a key competitor dominates a term you're targeting.

This is where third-party tools like Helium 10 or Jungle Scout provide essential market context—estimated search volumes, competitor keyword strategies, and historical trends. For a true competitive edge, a dedicated keyword search tool can pinpoint high-volume, low-competition opportunities specific to the Amazon marketplace.

The Headline POV: Triangulate your data. Use third-party tools for discovery and competitive analysis. Then, validate those insights against your own Search Query Performance data to confirm their relevance to your products and conversion rates. This process prevents wasting ad spend on high-volume keywords that simply don't convert for your specific offer.

To help you build a more robust keyword strategy, here’s a breakdown of the most common data sources.

Comparing Amazon Keyword Data Sources

This table provides a practical guide on where to source your keyword insights, comparing Amazon's direct data with third-party tool offerings.

| Data Source | Primary Use Case | Key Strength | Limitation |

|---|---|---|---|

| Amazon SQP | Validating which keywords actually drive profitable conversions for your products. | 100% accurate, ground-truth conversion data for your ASINs. | No competitor data or total market search volume estimates. |

| Amazon Brand Analytics | Understanding market-wide search frequency and top-clicked ASINs for competitive benchmarking. | Official Amazon data on keyword popularity and market share. | Provides relative rank (Search Frequency Rank), not exact volume. |

| Third-Party Tools | Discovering new keyword opportunities and analyzing competitor strategies. | Provides estimated search volume, historical data, and competitor insights. | Data is estimated and can have accuracy discrepancies. |

Ultimately, a winning strategy requires all three. Use third-party tools for discovery, Brand Analytics for market context, and SQP for validation and profit analysis.

Evaluating Keyword Tracker Tools

Not all keyword trackers are created equal. When evaluating a tool for your tech stack, look beyond the dashboard and scrutinize the data's quality and depth.

Here’s a no-nonsense checklist for evaluating a platform:

- Data Accuracy: How closely do its search volume estimates align with your own SQP and Brand Analytics data? Spot-check your top 10 keywords for significant discrepancies.

- Historical Depth: Does the tool offer at least 12-24 months of historical keyword data? This is non-negotiable for identifying seasonality and making informed forecasts.

- Competitive Intelligence: How seamlessly can you input a competitor's ASIN and view their ranking keywords, both organic and sponsored? This is critical for conquesting campaigns.

- Granularity: Does the tool clearly differentiate organic rank from sponsored rank? Knowing you're paying for sponsored rank #3 when your organic listing is at #4 is a crucial insight for budget optimization.

Your objective is to find a platform that provides more than search volume. The best tools layer in performance metrics like estimated sales to provide a complete picture. A keyword with 10,000 monthly searches driving 50 sales is far less valuable than one with 5,000 searches driving 200 high-margin sales. That distinction is the key to profitability. For a deeper look at what shoppers are hunting for, our analysis of the most searched terms on Amazon offers valuable market-level context.

A Repeatable Workflow for Actionable Insights

A powerful keyword tracking tool is useless without a disciplined process. Without a repeatable workflow to translate raw data into profitable action, you'll drown in numbers. This is about building a system for rapid analysis and decisive execution.

First, stop treating all keywords equally. A blanket approach wastes resources. Segment your keyword lists based on strategic importance to create a clear hierarchy for monitoring and action.

This entire process is about synthesizing data from disparate sources—Amazon reports, third-party tools—into a single, cohesive strategy.

This workflow visualizes how to blend Amazon's ground-truth data with competitive insights to gain a comprehensive market view.

Segmenting Your Keyword Portfolio

Strategic segmentation focuses your energy on what drives results. We recommend bucketing keywords into these key groups to move from reactive adjustments to proactive, goal-aligned moves.

- Core Revenue Drivers: Your top 10-20 "money" keywords. They drive significant search volume, convert at a high rate, and are directly responsible for a large share of your organic sales. Performance here is non-negotiable.

- Competitor Conquests: High-value keywords where your primary rivals dominate organic and sponsored placements. Winning here is a direct play to capture market share.

- Growth Opportunities: Long-tail keywords or emerging search terms with a clear path to page one. Lower volume today, but they represent future revenue streams.

- Defensive Plays: Your established turf. You already own top positions, so the objective is not growth but monitoring and defending your rank from aggressive competitors.

Organizing your tracker this way immediately clarifies which part of your strategy requires attention.

Setting a Performance Baseline

Before launching any optimization effort, establish a clear baseline. Without a starting point, you cannot accurately measure impact or ROI. A proper baseline is a full performance snapshot.

A baseline captures your organic rank, sponsored rank, conversion rate, and sales velocity for a target keyword before you make a change. This allows you to measure the true lift from your efforts, proving ROI and justifying future investment.

For example, to improve rank for "organic dog treats," your baseline would record your exact organic position and average daily sales from that term for the two weeks prior. After optimizing the listing, you compare new data against the baseline to quantify the precise impact. No more guesswork.

Establishing a Monitoring Cadence

Checking every keyword daily is inefficient and leads to analysis paralysis. Your monitoring frequency should align with the strategic importance of your keyword segments.

A typical monitoring cadence for high-growth brands looks like this:

- Daily Check (5-10 Minutes): A quick review of Core Revenue Drivers and any keywords tied to a major promotion or launch. The goal: catch catastrophic drops immediately.

- Weekly Review (30-60 Minutes): A deeper analysis across all segments. Identify broader trends, track progress on Competitor Conquests, and spot emerging Growth Opportunities.

This structured approach is essential for managing complex catalogs. The Amazon marketplace is built on keywords, and tracker tools have become essential infrastructure. Over 300,000 brands rely on specialized platforms that have collectively driven over $34 billion in sales. Today, top sellers track hundreds of keywords, making a robust tracker an operational necessity. For more on this, explore the leading keyword research tools on viral-launch.com. A disciplined workflow ensures your team makes data-backed decisions that move the needle, rather than drowning in irrelevant numbers.

Turning Keyword Data into Profitable Action

Data is useless until it informs a decision. The value of keyword tracking lies in the profitable actions it empowers, translating directly into smarter ad spend, a more resilient organic presence, and a healthier bottom line.

The objective is to create a dynamic feedback loop between your keyword data and your execution strategy. Every shift in rank or search volume is a market signal telling you where to invest your next dollar or optimization hour.

The 'If-Then' Playbook for PPC Optimization

The most efficient way to turn data into action is through a rules-based "if-then" framework. This removes emotion and guesswork from PPC management, enabling rapid, precise responses based on a pre-defined playbook.

Here are three high-impact scenarios every brand leader should have a plan for:

- IF organic rank for a core keyword drops out of the top 5, THEN strategically increase the exact match PPC bid. This defends sales velocity and prevents the A9 algorithm from further deprioritizing your listing.

- IF a product secures a stable top-3 organic rank for a high-volume keyword, THEN methodically reduce exact match ad spend for that term to improve TACOS without sacrificing total sales.

- IF a competitor begins bidding aggressively on your branded terms, THEN launch a defensive Sponsored Brands campaign targeting your own brand name to protect your digital shelf space.

This approach transforms your keyword tracker from a reporting tool into a trigger for specific, pre-planned actions. The insights should directly inform the structure and management of your Amazon Ads campaigns, creating a symbiotic relationship between paid and organic efforts.

Using Keyword Insights to Fuel Content Experiments

Your keyword data is a goldmine for prioritizing listing optimizations. Instead of random A/B tests, you can run targeted experiments based on real search behavior.

Imagine your Amazon keyword tracker shows you are stuck on page two for a high-volume, high-relevance keyword like “waterproof hiking socks men,” but your product title is simply “Men’s Outdoor Socks.” This is a clear, data-backed optimization opportunity.

Frame this insight as a testable hypothesis: "By incorporating 'waterproof hiking socks' into the product title, we will improve organic rank and click-through rate for this target search query." This elevates a gut feeling to a measurable experiment.

A simple workflow for these tests:

- Identify Opportunity: Use your keyword tracker to find a high-potential keyword where your rank is between positions 10-30.

- Form a Hypothesis: State the exact change (e.g., add keyword to title, bullets, back-end terms) and the expected outcome (e.g., improved rank, increased sessions).

- Establish Baseline: Record the current organic rank, average daily sessions, and conversion rate for that keyword over a two-week period.

- Execute Test: Implement the change on your product detail page.

- Measure Results: After two weeks, compare the new performance data against the baseline to determine the true impact.

This systematic process enables continuous, data-proven improvements. Using your keyword tracker to fuel these tests in Amazon's Manage Your Experiments tool provides a significant strategic advantage.

Tying Keyword Rank to Business Health

Ultimately, the most sophisticated brands view keyword rank as a leading indicator of business health. A sudden, unexplained rank drop for a core keyword isn't just an SEO issue; it could be the first symptom of a much larger operational problem.

Consider this real-world case: a home goods brand noticed its rank for "bamboo bath towels" crashed from #3 to #12 overnight. Instead of merely increasing PPC bids, they investigated.

- They analyzed the search results and found no new major competitors or promotions.

- They reviewed their own ASIN metrics and discovered the conversion rate had dropped by 15% in the last week.

- They checked recent customer reviews and found three new one-star reviews complaining about poor absorbency.

The rank drop was a symptom. The root cause was a quality control issue killing their conversion rate, signaling to Amazon's algorithm that the product was becoming less relevant. By using their keyword tracker as an early-warning system, they identified and addressed the core problem before it caused lasting brand damage. This is the level of insight that separates market leaders from the rest.

Using Historical Data to Predict Market Trends

It's easy to get caught in the daily churn of rank fluctuations. However, reacting to every minor dip is a tactical error. Strategic wins come from understanding the market's rhythm over months and years. This is where historical data from your keyword tracker amazon becomes a forecasting tool.

Instead of just reacting, you begin anticipating. Long-term trend analysis turns a simple report into forward-looking business intelligence.

Identifying Seasonality and Demand Peaks

Every product category has a pulse. Your keyword tracker’s historical view lets you hear it clearly. By analyzing trend graphs over the last 12-24 months, you can pinpoint precisely when customers begin searching for products tied to seasons, holidays, or events.

A brand selling "insulated water bottles" would see search volume begin to climb in April, peak in July, and taper off by September. This is not just an interesting data point; it's an actionable directive from the market.

This foresight enables you to:

- Align Inventory Planning: Ensure FBA warehouses are stocked before the demand spike, preventing stockouts that kill sales velocity and organic rank.

- Optimize PPC Budgeting: Know exactly when to ramp up ad spend to capture rising demand and secure top-of-search placements when they matter most.

- Schedule Content Refreshes: Plan to update A+ Content and imagery just ahead of the peak season to maximize conversions when traffic is highest.

This proactive approach transforms the annual seasonal scramble into a calculated, profitable campaign.

Separating Signal from Noise

A sudden rank drop can trigger panic. With historical context, you can diagnose the issue before overreacting. Is this a temporary market fluctuation or the start of a genuine decline?

Imagine your rank for a primary keyword falls from #4 to #9. Without historical data, the first instinct is often to increase PPC spend. However, a broader view might reveal that a top competitor is running a massive pre-Prime Day promotion, temporarily dominating the search results. This is a short-term event, not a fundamental flaw in your listing.

Historical data provides the confidence to differentiate between a competitor's aggressive (and temporary) promotion and a true decline in your product's relevance. One requires strategic patience; the other demands immediate action.

This perspective prevents costly, knee-jerk reactions and focuses resources on the battles that impact long-term success.

Uncovering Sleeper Keywords

Some of the most valuable keywords are not those with massive search volume today, but the "sleeper" terms quietly gaining momentum. These are emerging trends your competitors likely haven't noticed.

Analyzing multi-month data helps you spot keywords with a consistent upward trajectory. A term like "non-toxic cookware," for example, might show a 20% quarterly increase in search volume over the past year. This is a clear signal of a growing consumer movement.

Modern keyword tracker amazon tools have made this analysis far more accessible, with many providing two years of historical data. Since approximately 70% of shoppers never click past the first page, understanding and acting on these long-term trends is critical. You can learn more about the best Amazon keyword software from igppc.com.

By identifying these sleeper keywords early, you can optimize your listings and build authority before they become hyper-competitive, staking your claim in tomorrow's high-demand niches.

Frequently Asked Questions About Amazon Keyword Tracking

Even for experienced eCommerce leaders, keyword tracking can be complex. The goal is to move from passively reviewing reports to making decisive, profitable moves.

Here are no-nonsense answers to common questions from brands focused on winning on Amazon.

How Often Should I Actually Check My Keyword Rankings?

There is no one-size-fits-all answer. Your monitoring cadence should be dictated by the strategic value of the keyword. A blanket approach is either a waste of time or a missed opportunity.

For your core, high-volume keywords—the terms that drive the majority of your sales—a daily check is non-negotiable. This is especially true during a product launch, a major promotional event like Prime Day, or when actively contesting a top position. A quick daily review can identify a potential disaster before it erodes a week's worth of sales.

For secondary keywords and those in an exploratory phase, a weekly review is sufficient. This provides enough data to identify meaningful trends and assess the impact of your optimization efforts without getting lost in daily noise.

My Organic Rank Just Dropped. What's the First Thing I Should Do?

Do not panic, and do not immediately increase PPC spend. This is a common, costly reaction that often fails to address the root cause.

Instead, become a diagnostician. Follow this process to understand the why behind the drop:

- Analyze the SERP. Open an incognito window and search for the keyword on Amazon. Is a competitor now dominating with a new Sponsored Brands video ad? Has another product earned a "Best Seller" badge, increasing its click-through rate? The answer is often visible on the search results page itself.

- Scrutinize your own metrics. In Seller Central, examine the ASIN's performance. Has its conversion rate or sales velocity declined over the past 7-14 days? A dip in conversions is a major negative signal to Amazon's algorithm and a primary driver of rank loss.

- Review your PPC data. How are ad campaigns for that exact keyword performing? If the click-through rate (CTR) on your ads has also fallen, it suggests a broader issue with your main image or offer, not just an isolated organic problem.

This diagnostic approach will lead you to the root cause, helping you decide whether the right move is to adjust ad bids, A/B test a new main image, or address a product quality issue surfaced in recent reviews.

A drop in rank is a symptom, not the problem. A proper diagnosis ensures you treat the underlying cause—like a declining conversion rate—rather than applying a costly band-aid with more ad spend.

Can I Just Rely on Third-Party Keyword Data?

Relying solely on third-party tools is a critical mistake. While these tools are invaluable for competitive intelligence, trend spotting, and estimating search volume, their data is ultimately an approximation. You cannot build a multi-million dollar strategy on an estimate.

The most effective strategy is a hybrid model. Use third-party tools for discovery and competitive landscaping. They are excellent for generating new keyword ideas and reverse-engineering a competitor's strategy.

However, your ground truth must always be your own first-party data from Amazon. The Search Query Performance (SQP) report is your ultimate source of truth. It tells you exactly which terms customers used to find and—most importantly—purchase your products. Use tools to form a hypothesis, but always use Amazon's own data to validate it before allocating significant budget.

Takeaway: A sophisticated keyword tracking strategy is not about monitoring ranks; it's about building a data-driven system where PPC and organic efforts work in concert to drive profitable growth. By connecting keyword performance directly to business outcomes, you create a sustainable competitive advantage. At Headline Marketing Agency, we transform keyword data into a strategic asset, building comprehensive PPC and organic programs that secure market leadership and boost your bottom line.

Discover how our data-first approach can scale your brand on headlinema.com

Ready to Transform Your Amazon PPC Performance?

Get a comprehensive audit of your Amazon PPC campaigns and discover untapped growth opportunities.