How to Calculate Profit Margins for Sustainable eCommerce Scale

Learn how to calculate profit margins to drive eCommerce growth. Master gross, operating, and net margins with actionable steps and real-world examples.

Chasing top-line revenue is a vanity metric. I’ve seen countless eCommerce brands with skyrocketing sales charts run straight into a cash-flow crisis. Sustainable scale isn’t about selling more—it’s about keeping more of what you sell. That all comes down to a surgical understanding of how to calculate profit margins.

We're not just talking about one number. True financial command comes from mastering the three core profit levers: gross, operating, and net profit. This guide will equip you to use these metrics not just for reporting, but for making smarter, more profitable decisions.

Why Profit Margins Matter More Than Revenue

It’s a classic trap for entrepreneurs. Your sales charts are pointing straight up, but you're constantly scrambling for cash. How is that possible? It happens when you fixate on sales volume as your primary health metric, ignoring the costs chipping away at every dollar you bring in.

Profit margins are your financial diagnostic tools. They deliver an unflinching look at your company’s health at different stages, preventing you from flying blind. Before we dig into the calculations, it's helpful to understand the definition of profit margin as a concept. It's a story told in three distinct parts, each answering a critical question about your business.

The Three Core Profit Margins

Think of these three margins as layers. Peeling each one back reveals a deeper truth about your financial performance and where your money is actually going.

- Gross Profit Margin: This is your first checkpoint. It measures the raw profitability of your products before any operational overhead like marketing or rent. This is a direct reflection of your pricing and sourcing strategy.

- Operating Profit Margin: This layer diagnoses the efficiency of your core business operations. It factors in all the costs of running the company day-to-day—salaries, software, and critically, your advertising spend.

- Net Profit Margin: This is the famous "bottom line." It shows what percentage of revenue is left after every single expense, including interest and taxes, has been paid. It’s the ultimate verdict on your company's overall profitability.

To make this crystal clear, here’s a quick-reference table with the formulas.

The Three Profit Margin Formulas

| Margin Type | Formula | What It Measures |

|---|---|---|

| Gross Profit Margin | (Revenue - COGS) / Revenue x 100 |

The profitability of your products alone. |

| Operating Profit Margin | Operating Income / Revenue x 100 |

The efficiency of your core business operations. |

| Net Profit Margin | Net Income / Revenue x 100 |

The overall profitability after all expenses. |

Having these on hand helps you quickly diagnose where profits are leaking.

By analyzing these three margins together, you move from simply tracking sales to making strategic, data-backed decisions. You can pinpoint whether a profitability issue stems from poor unit economics, bloated operating expenses, or an inefficient financial structure.

Here’s a real-world Amazon scenario. A CPG brand we audited had a fantastic 65% gross margin on their hero product. Yet when we ran the numbers, their net margin was a razor-thin 4%. This is a massive red flag. It proved the product itself was a winner, but something else was incinerating their cash—in this case, an out-of-control PPC strategy with no connection to unit profitability. Without this layered insight, they might have made the classic mistake of sourcing a cheaper, inferior product, crippling the one part of the business that was actually working.

Learning how to calculate and interpret these margins is the first step toward building a resilient and genuinely profitable brand. It’s about shifting your focus from vanity metrics to the numbers that define sustainable success.

Finding Your Gross Profit Margin: The First Step to Real Profitability

If you want to understand your product's financial health, your Gross Profit Margin is the first place you need to look. It’s the simplest, most powerful metric for seeing how much money you actually make from a sale before you even think about operational costs like marketing or salaries. This is all about the raw profitability of your inventory.

Getting this number right means you have to be crystal clear on two things: your Revenue and your Cost of Goods Sold (COGS). If you get either of these wrong, your entire financial picture will be distorted.

Think of it like this: every single cost, from the factory floor to the shipping container, eats into your final net margin. That’s why getting your COGS calculation right is non-negotiable.

Nailing Your Revenue and COGS Calculation

The formula for Gross Profit Margin looks simple enough on paper: (Revenue - COGS) / Revenue x 100. The real trick is making sure the numbers you plug into it are accurate.

Revenue (or Net Sales) isn't just your top-line sales figure. You need to account for deductions to get the real number. This means subtracting:

- Returns and Refunds: The value of any products that came back to you.

- Discounts and Promotions: Any coupon codes or sale prices you offered.

Cost of Goods Sold (COGS) represents the direct costs tied to producing or sourcing your products. For most eCommerce sellers, this will include:

- Product Sourcing Costs: What you paid your supplier for the goods.

- Inbound Shipping: The cost to transport your inventory from the supplier to a warehouse or an Amazon FBA center.

- Duties and Tariffs: Any import fees you had to cover.

- Direct Labor: If you manufacture your own products, this is the cost of the labor directly involved in making them.

One of the most common mistakes is miscategorizing expenses. Outbound shipping fees (getting the product to the customer), Amazon referral fees, and your ad spend are operating expenses, not COGS. They impact your operating margin, not your gross margin.

Getting this right is crucial. To get a better handle on how advertising specifically impacts your bottom line, our guide on how to calculate TACoS is an essential read.

So, What's a Good Gross Profit Margin?

This is the million-dollar question, and the answer varies wildly depending on your industry. But we can still find a solid benchmark. An analysis of S&P 500 companies from 2001 to 2022 showed that the average gross margin held remarkably steady at around 43%. While your specific eCommerce niche might be different, that 43% figure gives you a powerful target to measure yourself against.

Let’s walk through a quick example. Imagine a brand sells a coffee maker for $100.

- COGS: The unit costs $40 from the supplier, plus $5 for inbound shipping and tariffs. Total COGS = $45.

- Revenue: They sell 1,000 units. But 50 were returned, and they offered an average discount of 10%. So, Net Revenue = (950 units sold * $90 sale price) = $85,500.

- Total COGS: 950 units * $45 = $42,750.

- Gross Profit: $85,500 - $42,750 = $42,750.

- Gross Profit Margin: ($42,750 / $85,500) x 100 = 50%.

A 50% gross margin is quite healthy. It means for every dollar in sales, you have 50 cents left to cover all your other business expenses—marketing, salaries, software—and hopefully, leave some net profit at the end. If this number is weak, you have a sourcing or pricing problem that no amount of clever marketing can fix.

Using Operating Profit Margin to Assess Core Business Health

If your gross margin shows your product's potential, your Operating Profit Margin reveals your business's real-world efficiency. This is where the rubber meets the road. It tells you exactly how much profit you’re generating from your core, day-to-day operations—after paying for everything needed to run the business.

We're talking about marketing, salaries, warehouse rent, and all those software subscriptions that add up. This metric is critical because it strips away variables like interest payments and taxes, giving you a clean, unfiltered look at your operational strength. A high operating margin means you run a tight ship. A low one signals operational bloat or, more often than not, inefficient ad spend that requires immediate intervention.

Calculating Your Operating Profit Margin

To find your Operating Profit Margin, you first need your Operating Income. You get this by subtracting all your operating expenses from your gross profit. Then, you simply divide that number by your total revenue.

Here’s the formula:Operating Profit Margin = (Operating Income / Revenue) x 100

Your operating expenses, often called Selling, General & Administrative (SG&A) expenses, are all the costs required to run the business that aren't directly tied to producing a single unit.

These typically include things like:

- Marketing and Advertising: Your Amazon PPC spend, social media ads, and other promotional costs.

- Salaries and Wages: Compensation for your non-production staff (like your marketing team or VAs).

- Rent and Utilities: The costs for your office, warehouse, or storage space.

- Software Subscriptions: Fees for inventory management tools, analytics platforms, and so on.

- Fulfillment Costs: This is a big one—think Amazon FBA fees or 3PL costs.

Getting this calculation right is how you transition from just selling products to building a truly profitable machine.

A Real-World DTC Brand Example

Let’s stick with our coffee maker brand. They brought in $85,500 in revenue and had a $42,750 gross profit. Now, it's time to factor in their monthly operating expenses to get a clearer picture.

- Amazon Ad Spend: $12,000

- Salaries: $8,000

- Software Fees: $1,500

- Fulfillment (FBA Fees): $7,000

First, add up the Total Operating Expenses:$12,000 + $8,000 + $1,500 + $7,000 = $28,500

Next, find the Operating Income:$42,750 (Gross Profit) - $28,500 (Operating Expenses) = $14,250

Finally, we can calculate the Operating Profit Margin:($14,250 / $85,500) x 100 = 16.7%

An operating margin of 16.7% tells a clear story. While the product itself is quite profitable (that 50% gross margin looked great!), a huge chunk of that profit is being eaten up by the costs of running the business—especially the ad spend. This is a classic scenario where PPC management becomes a major lever for improving profitability. This isn't just a marketing cost; it's a direct drag on operational efficiency.

It's also worth noting how wildly operating margins can vary across different sectors. For instance, some of the top global exchanges have hit operating margins over 60%, while the average for investment services firms hovered around 21%. This shows why knowing your industry's benchmarks is key. You can explore more about these industry profit margin variations to see how you stack up.

Calculating Net Profit Margin for the Complete Financial Picture

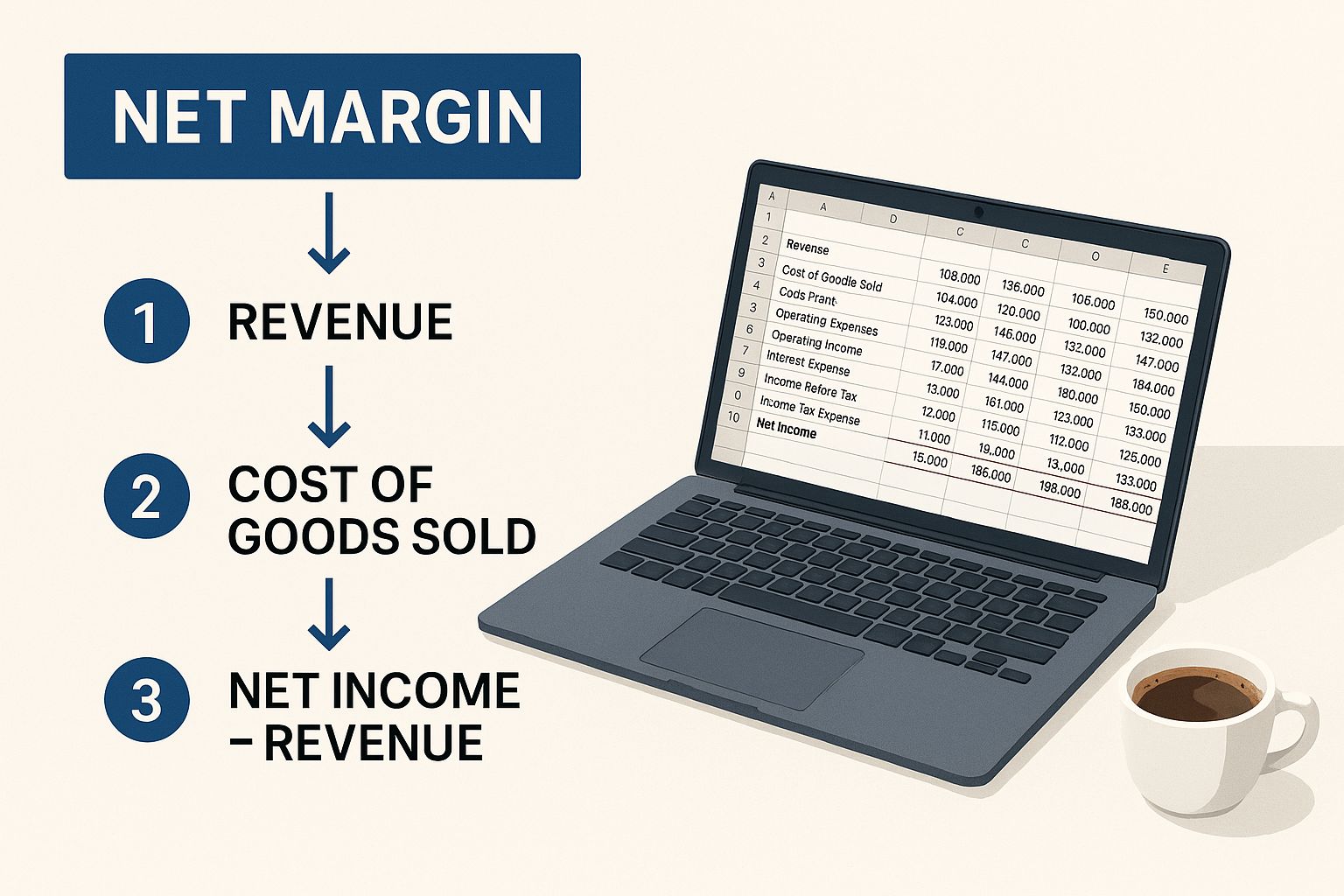

So, we've looked at gross margin for product profitability and operating margin for business efficiency. Now it's time for the final verdict: Net Profit Margin.

This is the ultimate “bottom line.” It tells you exactly what percentage of revenue is left after every single expense has been paid, right down to interest and taxes. It’s the truest measure of a company’s overall financial health and its ability to generate sustainable cash flow.

Net profit margin gives you the most complete view because it factors in things beyond your day-to-day operations. A heavy debt load with high interest payments can sink an otherwise efficient business. The same goes for a tough tax situation. This is exactly why two companies with identical operating margins can end up with wildly different financial results. This metric is crucial for making smart, long-term decisions about investments, financing, and sustainable growth.

The Final Calculation

The formula itself is pretty simple. You just divide your Net Income by your total Revenue.

Net Profit Margin = (Net Income / Revenue) x 100

To get your Net Income, you start with your Operating Income and then subtract any non-operating costs. These are the expenses that aren't tied to your core business activities.

- Interest Expenses: This is the cost of any loans or debt you're carrying.

- Taxes: Your corporate income tax bill.

It's critical to see how these pieces fit together. You might take out a high-interest loan to fund inventory. Even if your PPC campaigns are driving record operating income, that interest payment could completely wipe out your net profit. Tying ad performance to the bigger profit picture is non-negotiable, a topic we explore in our guide on how to calculate return on ad spend.

A Tale of Two Brands

Let's go back to our coffee maker brand and bring in a competitor, "Brand B." To make it interesting, let's say both have the exact same Operating Income of $14,250.

Our Brand: Is debt-free and pays $2,850 in taxes.

- Net Income:

$14,250 - $2,850 = $11,400 - Net Profit Margin:

($11,400 / $85,500) x 100 = 13.3%

- Net Income:

Brand B: Is carrying a hefty loan, paying $5,000 in interest on top of a $1,950 tax bill.

- Net Income:

$14,250 - $5,000 - $1,950 = $7,300 - Net Profit Margin:

($7,300 / $85,500) x 100 = 8.5%

- Net Income:

This example is a masterclass in why net margin matters. Even with identical operational performance, our brand is nearly 5% more profitable. The competitor's debt is actively eroding their bottom line. It's a perfect illustration of how financing and tax strategies can make or break profitability. This is the complete financial story that only the net margin can tell.

Turning Margin Calculations Into Strategic Action

Knowing your profit margins is one thing. Actually using them to drive profitable growth is where leadership makes its mark. These percentages aren't just numbers for a P&L statement; they are diagnostic tools. They tell you exactly where to focus your energy—whether it’s renegotiating with suppliers, optimizing ad spend, or cutting losing products.

The key is to move from a single snapshot to trend analysis. A dip in your operating margin one month could be a fluke. A steady decline over three quarters is a systemic problem, like creeping ad costs or operational bloat. Your goal is to use these numbers to get ahead of problems, not just react to them.

From Data Points to Profit Levers

Once you have a clear picture of your margins, you can start pulling specific levers to improve them. Small, targeted adjustments often have the biggest impact.

Here are a few powerful ways to put your margin analysis to work:

- SKU-Level Profitability Analysis: An acceptable overall gross margin can easily hide unprofitable "zombie" SKUs. Calculate the margin for your top 20% of SKUs. You might be shocked to find a "bestseller" is barely breaking even, while a slower-moving item is secretly funding your growth. This is where you get strategic with ad spend, allocating budget to your most profitable products to fuel both sales and organic rank.

- Refine Your Pricing Strategy: Is your gross margin consistently lower than industry benchmarks? That’s a massive red flag. Small, incremental price increases can do wonders for your margins, and you’d be surprised how often they go unnoticed by loyal customers, especially if you’ve built a strong brand.

- Conduct an Operating Expense Audit: If your operating margin is shrinking, it's time for an audit. Go through every single line item—software subscriptions you forgot about, agency retainers, shipping suppliers. Renegotiating a few contracts or cutting redundant tools can immediately pad your bottom line. PPC spend is often the biggest line item here and the one with the most potential for optimization.

Takeaway: Your profit margins give context to every other KPI you track. A low ACoS is completely meaningless if the product you're advertising has a 10% gross margin. True performance-first marketing connects every single action back to profitability. PPC isn’t just a sales driver; it’s a primary lever for improving your operating margin and funding sustainable growth.

Contextualizing Your Margins in the Broader Economy

Finally, don't operate in a vacuum. The wider economy has a huge impact on profitability. For instance, fascinating research on U.S. profit margins showed that sustained government fiscal policy, with deficits averaging 6.6% of GNP from 2012 to 2022, directly propped up corporate profits. You can dive into the details in the full GMO research paper.

Understanding these big-picture trends helps you set realistic goals and benchmarks. Tying your ad performance back to these high-level financial metrics is what separates good marketers from great business partners. To get a better handle on this, check out our guide on how to calculate marketing ROI and see how every dollar you spend trickles down to your final net profit. When you combine your internal data with an awareness of external economic forces, your margin calculations stop being just numbers—they become a serious strategic advantage.

Common Questions About Calculating Profit Margins

Once you get the hang of the formulas, the real questions start popping up. It's one thing to calculate a margin in a spreadsheet, but it's another to apply it to the messy reality of an eCommerce business. Let’s tackle the most common sticking points for eCommerce leaders.

What Is a Good Profit Margin?

This is, without a doubt, the question I hear most often. And the honest answer is always the same: it completely depends on your industry and business model.

A brand selling high-volume, low-cost items might thrive with a 10% net margin. A luxury goods company might need to hit 40% or more to stay in the game.

Instead of hunting for one magic number, focus on two key things:

- Your Industry: Get familiar with the typical margins for your specific niche. Selling electronics is a totally different ballgame than selling apparel or supplements. Each has its own financial fingerprint.

- Your Trends: This is more important than any static number. Is your operating margin ticking up each quarter, or is it slowly being eroded? The direction your margin is heading tells you a much richer story than a single snapshot ever could.

Should I Focus More on Gross, Operating, or Net Margin?

All three are vital, but they tell you different parts of the story. Think of them as a diagnostic tool for your business's health.

Your gross margin is your first line of defense. If it's weak, nothing else you do will fix the fundamental problem that your product isn't profitable enough.

Your operating margin is your efficiency report card. It shows you how well you're managing the costs of actually running the business, like marketing, salaries, and fulfillment.

Finally, your net margin is the bottom line. It's the ultimate truth-teller about whether the business as a whole is making money after everything is paid.

Recommendation: Don't play favorites. Use all three margins in concert. I've seen brands with amazing gross margins get absolutely torched by inefficient ad spend, a problem that screams out when you look at their operating margin. Viewing all three provides the complete narrative of your business's health.

How Often Should I Calculate My Margins?

For any fast-moving eCommerce brand, you should be looking at your profit margins monthly at a bare minimum. A monthly check-in is frequent enough to catch a negative trend before it spirals into a real disaster.

If your business has a hefty ad spend or your cost of goods fluctuates a lot, you might even want to do a quick check-in every two weeks. It can give you a serious strategic edge. And for those moments when you just need a quick answer, using an online margin calculator can be a real lifesaver.

At Headline, we believe that true Amazon growth is built on a foundation of profitability. We go beyond surface-level metrics to connect every dollar of your ad spend directly to your bottom line, turning complex data into clear, actionable strategies that drive sustainable scale. Discover how our data-driven approach can maximize your profitability on Amazon.

Ready to Transform Your Amazon PPC Performance?

Get a comprehensive audit of your Amazon PPC campaigns and discover untapped growth opportunities.