How to Find Amazon Keywords That Actually Drive Profit

Stop guessing and start selling. Learn how to find Amazon keywords using PPC data, competitor analysis, and SQP reports to boost your organic rank.

To find Amazon keywords that fuel profitable growth, you must look beyond raw search volume and focus on performance data. The most potent insights aren't in a third-party tool; they're in your own PPC campaigns and Amazon's Search Query Performance dashboard. These sources reveal the exact terms shoppers use moments before they convert, shifting your strategy from simply 'getting seen' to 'getting sold.'

Move Beyond Vanity Metrics to Find Profitable Keywords

Let's be transparent—stuffing your listings with high-volume, generic keywords is a shot in the dark, not a scalable strategy. For too long, brands have chased search volume as the primary KPI. The problem? Traffic that doesn't convert is just a line item on your P&L, burning through ad budget and delivering vanity metrics that don't impact the bottom line.

Amazon's A9 algorithm has evolved. It doesn't just reward visibility; it rewards performance. It elevates listings that efficiently turn browsers into buyers. If your product converts at 15% for a specific keyword, you will consistently outrank a competitor converting at 5% for the same term—even if they have more reviews or a longer sales history.

This demands a performance-first mindset. The strategic question shifts from, "How many people search for this?" to, "Do the people searching for this actually buy my product?"

PPC is Your Ultimate Research Tool

Your advertising campaigns are more than a sales channel; they are your proprietary keyword research laboratory. While third-party tools provide educated estimates based on market data, your PPC performance reports deliver cold, hard proof of what drives conversions for your brand. Every dollar spent on a Sponsored Products auto campaign is an investment in market intelligence, revealing the real-world search terms customers use just before they click "Add to Cart."

Consider the difference:

- Third-party tools are a market forecast—a valuable, but generalized, prediction based on past data.

- Your PPC search term report is real-time, ground-truth data. It's what's happening in your business right now.

This data is an invaluable asset. It creates a powerful feedback loop where paid advertising directly fuels organic growth. Once you identify high-converting terms in your ad reports, you've found the precise language of your target customer. Integrating these proven terms into your product title, bullet points, and backend search fields signals to Amazon that your listing is hyper-relevant for queries that lead directly to sales.

Your goal isn't just to find Amazon keywords; it's to find your keywords. These are the terms that connect your specific product to a high-intent buyer, creating a powerful flywheel of conversion, ranking, and profitability that builds a sustainable competitive advantage.

The Shift from 'Getting Seen' to 'Getting Sold'

When you anchor your strategy in your own performance data, you stop wasting budget competing on broad, expensive head terms and start dominating profitable niches. Instead of blowing your budget fighting for a term like "running shoes," your PPC data might reveal your real money-maker is "lightweight trail running shoes for wide feet."

This targeted, data-backed approach creates a ripple effect across your entire Amazon operation:

- Improved Organic Rank: Higher conversion rates on specific keywords directly boost your organic visibility for those same terms, a core function of the A9 algorithm.

- Lower ACOS: Concentrating ad spend on keywords with a proven conversion history naturally lowers your Advertising Cost of Sale (ACOS).

- Sustainable, Profitable Growth: A durable business is built on conversions and margin, not just traffic.

Ultimately, the most effective way to find Amazon keywords is to let your customers tell you what they are. By mining your own performance data, you move from guessing what might work to knowing what does. Your advertising transforms from a cost center into the primary engine for profitable, long-term growth.

Mine Your Search Query Performance Data for Gold

Forget third-party tools for a moment. Your most powerful keyword insights are already inside your Seller Central account. I’m talking about the Search Query Performance (SQP) dashboard—a goldmine of first-party data that shows you the exact path shoppers take from search to purchase. For any serious brand leader, ignoring this data is a critical mistake.

This isn't just another report to download. It’s a direct window into your customer's mind. When you dig into the data, you can see precisely how shoppers behave at every step of the funnel, turning raw numbers into smart, profitable decisions for both your listings and your PPC campaigns.

Decoding the Customer Journey with SQP Metrics

The power of the SQP dashboard lies in its ability to break down performance for each search term across the entire sales funnel. The strategy isn't just knowing the numbers; it's understanding the relationship between them. That’s how you diagnose performance issues and spot optimization opportunities with precision.

Here’s the data you get and what it actually tells you:

- Impressions: Top-of-funnel visibility. How often did your product appear for a given search?

- Clicks: A direct measure of your primary image and title's effectiveness. Did you capture their attention on a crowded search results page?

- Adds to Cart: A strong indicator of purchase intent. They landed on your page, and your bullets, A+ Content, and images convinced them this might be the solution.

- Purchases: The ultimate validation. This confirms your entire offer—from price to reviews to shipping—was compelling enough to close the deal.

By analyzing these metrics together, you can pinpoint exactly where your listing is winning or losing. A term with high impressions but a low click-through rate? That's a clear signal your main image or title isn't compelling for that search query. High clicks but few "adds to cart" could mean a price mismatch or weak benefit copy in your bullet points.

Translating SQP Insights into Actionable Strategy

Data is useless without an action plan. The entire point is to translate these numbers into specific adjustments that move the needle. Let's walk through a real-world scenario for a brand selling a high-end "ergonomic office chair."

This is what a typical view inside Seller Central looks like, showing you the core metrics for different search queries.

This data is your roadmap. It tells you which terms are bringing in real, engaged shoppers and which ones are just wasting digital shelf space.

Let’s break down how to read this and build a plan.

Scenario One: The Underperformer

You spot the term "home office chair for back pain." It's getting 10,000 impressions, but the click-through rate (CTR) is a miserable 0.2%.

- Diagnosis: Shoppers seeking back pain solutions are seeing your chair but are not convinced it meets their needs from the search results page. Your primary image and title are failing to communicate the key benefit.

- Action: Immediately split-test a new main image that clearly highlights the chair’s lumbar support. Revise your title to include "with Adjustable Lumbar Support" to directly address the searcher's pain point.

Scenario Two: The Hidden Gem

You find a long-tail keyword, "leather executive chair with padded armrests." It only has 500 impressions, but the purchase conversion rate is a whopping 25%.

- Diagnosis: You've identified a hyper-specific, high-intent keyword your competitors have likely overlooked. These shoppers know exactly what they want.

- Action: Immediately create a new, single-keyword exact match PPC campaign for this term. Ensure "padded armrests" is featured prominently in your bullet points and visualized in your A+ Content to reinforce the message and secure the conversion.

This level of detail is crucial. With Amazon processing over 4 billion product searches monthly, Conversion Rate Optimization (CRO) is a massive ranking factor. Amazon’s algorithm is designed to favor listings that convert efficiently. Diving into Amazon's strategic landscape makes it clear why this first-party data is non-negotiable for sustainable growth.

The Search Query Performance dashboard closes the loop between your organic and paid efforts. It's the ultimate source of truth, revealing which keywords don't just get clicks, but actually drive sales and contribute to your bottom line.

By operationalizing the review of this data, you stop guessing. You start spotting new search trends before your competitors, fixing listing weaknesses with surgical precision, and fueling your ad campaigns with keywords already proven to convert. This is how you build a data-driven strategy that delivers real, sustainable growth.

Use PPC as Your Keyword Research Lab

Treat your PPC campaigns as more than an advertising expense. They are your personal keyword research laboratory. While other tools provide estimates, your Sponsored Products campaigns deliver hard evidence of what real shoppers are searching for right before they purchase. This is where you stop making assumptions and start building a strategy based on actual, profit-driving customer behavior.

This requires a strategic shift in how you view auto campaigns. They aren't just a simple sales tool; they are a keyword discovery engine. Instead of running a single, broad auto campaign, you structure it with one primary goal: to harvest new, high-intent search terms directly from customer behavior. This approach turns your ad spend into a powerful investment in market intelligence.

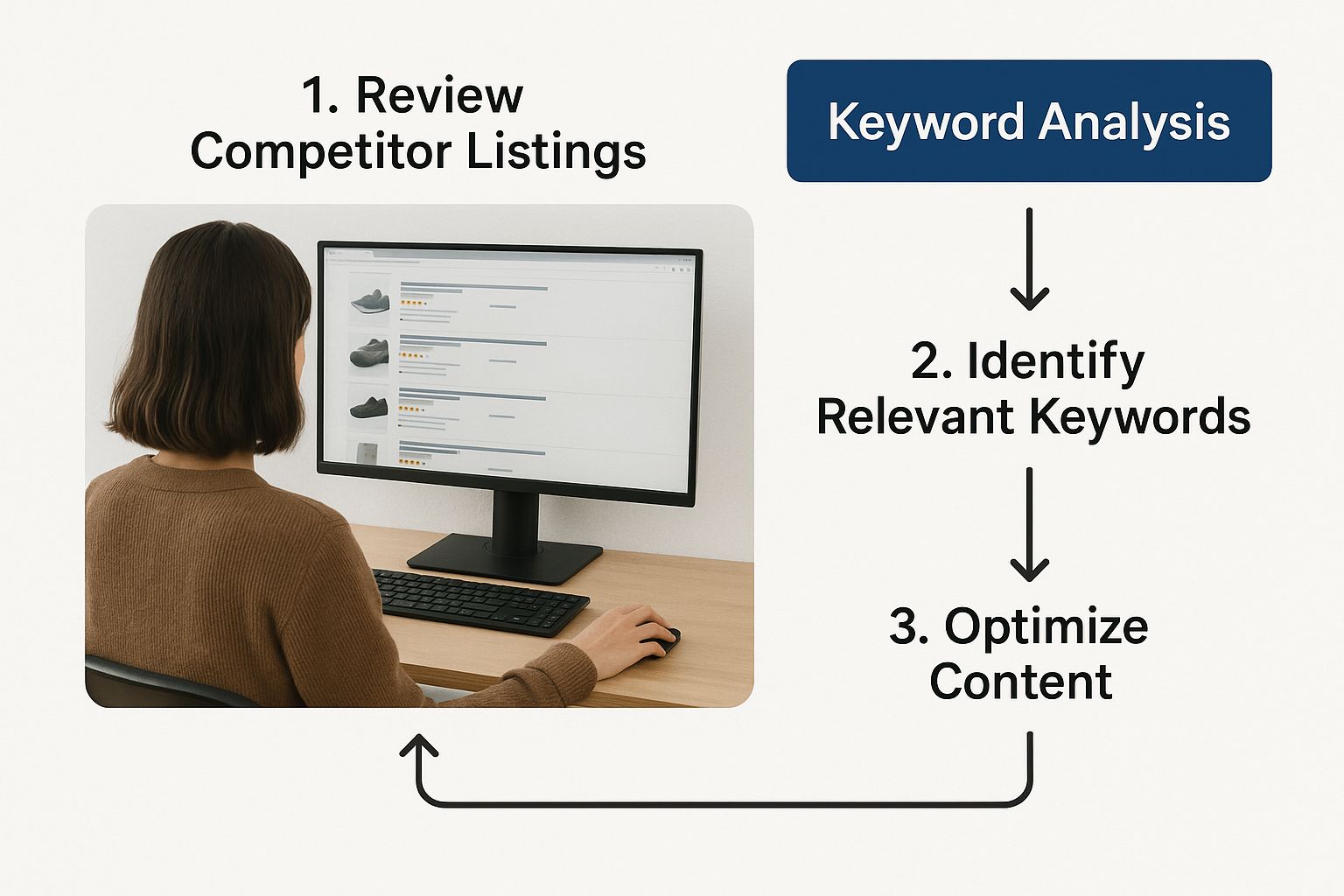

Analyzing competitor positioning and customer discovery paths is a critical piece of this puzzle.

This kind of analysis, fueled by real-world PPC data, builds a performance-first strategy that uses paid advertising as a lever for organic growth and long-term profitability.

Structuring Your Discovery Campaign

The setup is straightforward but requires discipline. Create a Sponsored Products automatic campaign for a single ASIN or a small, tightly-themed product group. The key is to set intentionally low bids. Remember, the objective isn't aggressive sales volume—it's cost-effective data collection.

Once running, Amazon's algorithm will match your product to a wide range of customer search queries. Your Search Term Report becomes your playbook, showing every keyword that generated an impression, a click, and—most importantly—a sale. You are essentially paying Amazon for direct insight into how customers find and buy your products.

From Discovery to Performance: The Keyword Graduation Process

Analyzing the Search Term Report is where strategy materializes. You are hunting for keywords with at least one conversion and clear commercial intent. These are the "golden nuggets" you will "graduate" from your discovery campaign into highly controlled manual campaigns where you can scale efficiently.

This creates a powerful, self-sustaining feedback loop:

- Harvest: Run your low-bid auto campaign to gather raw search term data from actual shoppers.

- Analyze: Regularly pull your Search Term Report and identify queries with at least one sale and a profitable ACOS.

- Graduate: Move these proven, high-converting terms into a manual exact-match campaign for precise bid control and scaling.

- Negate: Add the graduated keyword as a negative exact match in the original auto campaign. This critical step prevents you from bidding against yourself and ensures your discovery campaign remains focused on finding new terms.

Here’s a visualization of that workflow:

| Campaign Type | Keyword Source | Key Metric to Watch | Action |

|---|---|---|---|

| Auto (Discovery) | Amazon's Algorithm | Conversions | Harvest converting search terms. |

| Manual (Performance) | Harvested Terms | ACOS / ROAS | Graduate proven terms here for precise bidding. |

| Auto (Discovery) | N/A | Spend on Converted Terms | Add graduated terms as negative exact match. |

This "PPC Keyword Harvesting Workflow" ensures your ad spend is always allocated efficiently, either discovering new opportunities or scaling proven winners.

This structured approach allows you to systematically build a portfolio of profitable keywords backed by your own performance data. You're no longer allocating budget based on search volume estimates; you're making calculated investments in keywords that have already proven they convert for your specific product.

Stop treating your auto campaign as a 'set it and forget it' tool. It's an active research asset. By consistently harvesting and graduating keywords, you turn your ad spend into a direct investment in both organic ranking and future ad efficiency.

Analyzing the Data for True Intent

The insights from your reports can be surprisingly specific. Amazon keyword data is a goldmine for understanding shopper psychology. For instance, market data once showed the keyword "make videos for youtube" had a click-through rate over 100% on Amazon—an almost unheard-of figure indicating intense purchase intent from a very specific user segment.

Your own reports will reveal similar patterns. You might discover that shoppers convert on "bamboo bath caddy for freestanding tub" but not on the broader term "bathtub tray." That’s a clear directive to double down on that long-tail keyword in both your PPC campaigns and your listing's backend search terms.

This methodology fundamentally changes your advertising philosophy. It's no longer just about driving traffic. It's about methodically identifying the precise language of your customers and building a profitable, scalable growth engine around it. For brands looking to get even more sophisticated, exploring dedicated AI Marketing Software can provide a significant competitive advantage.

Validate Keywords Through Competitor Analysis

Your internal data—from the Search Query Performance dashboard and PPC reports—is your source of truth. But it doesn't exist in a vacuum. To build a resilient keyword strategy, you must benchmark your performance against the competitive landscape. This means stepping outside your own analytics to understand what’s working for the top players in your category.

Competitor analysis isn't about mimicry; it’s about strategic intelligence gathering. Understanding which keywords drive sales for other brands helps you uncover high-value opportunities, identify market gaps, and make smarter decisions about budget allocation. This is how you find keywords that are not only relevant but also commercially viable.

Reverse-Engineering Success with a Reverse ASIN Lookup

The most direct method for this intelligence is a reverse ASIN lookup. This process involves taking a competitor's ASIN, inputting it into a third-party tool, and extracting a list of all the keywords for which they rank, both organically and via paid ads. It's the equivalent of looking at their marketing playbook.

However, a raw data export is useless. The strategic value comes from analyzing the data to find patterns and opportunities your own data might not reveal.

First, identify your top three to five direct competitors—brands selling similar products at a similar price point to the same target audience. Once you have their ASINs, the deep dive can begin.

How to Strategically Analyze Competitor Keyword Data

With a list of competitor keywords, the real work begins. Your goal is to filter the noise and extract actionable insights to fortify your strategy. Focus on answering these key strategic questions:

- Where are the gaps? Identify keywords where your competitors rank highly (e.g., in the top 10 organic positions) but where you have little to no visibility. These are your most immediate expansion opportunities.

- What are their 'money' keywords? Pay close attention to terms where multiple competitors are bidding aggressively on PPC. If several market leaders are willing to spend money on a term, it’s a strong signal that it converts profitably.

- Are there neglected long-tail opportunities? Competitors may focus their budgets on broad, high-volume keywords. Comb through their data for specific, long-tail phrases where they may rank organically but aren't actively targeting with ads. These often carry lower competition and higher ROI.

This process is part data science, part strategic intuition. For a deeper dive, our guide on conducting an Amazon competitive analysis offers a complete, structured framework.

Competitor data isn't a shopping list of keywords to copy. It's a strategic map showing you where the market is, where it's headed, and where the untapped pockets of opportunity lie. Use it to validate your own findings and challenge your strategic assumptions.

Choosing the Right Tools for the Job

Attempting this level of analysis manually is inefficient and impractical. Specialized third-party tools are essential.

Powerful platforms like Helium 10 (with its Cerebro tool) are the industry standard for deep reverse ASIN analysis. Similarly, Jungle Scout’s Keyword Scout provides robust data on search volume and competitor performance. For brands on a tighter budget, tools like AMZScout offer the core lookup functions needed to get started. You can explore more of the best Amazon keyword research tools available to find the right fit for your brand.

Before fully committing resources to a new keyword discovered through competitor research, run it through a quick validation checklist. This ensures you’re making a data-backed decision, not just chasing a hunch.

Keyword Validation Checklist

| Validation Check | Source of Data | What Success Looks Like |

|---|---|---|

| Sufficient Search Volume? | Third-Party Tool (e.g., Helium 10) | Meets your minimum threshold (e.g., >500 searches/month) |

| High Competitor Rank? | Reverse ASIN Lookup | Multiple competitors rank in the top 1-15 organic spots |

| Strong PPC Bids? | Third-Party Tool | Competitors are actively spending on sponsored ads for this term |

| High Product Relevancy? | Your Own Product Knowledge | The keyword perfectly describes your product's core benefit or use case |

| Internal Data Signal? | Search Query Performance (SQP) | The keyword has already appeared in your SQP data with a good CTR or conversion rate |

This checklist forces a multi-faceted view of a keyword—considering market demand, competitive pressure, and internal performance—leading to a more confident and strategic decision.

By validating your own data against a clear picture of the competitive landscape, you shift from a reactive to a proactive strategy. You're no longer just putting out fires; you're anticipating market trends and positioning your brand to win. This holistic approach ensures your keyword strategy is not just comprehensive but built for long-term, sustainable profit.

Putting Your Keywords to Work

Identifying the right keywords is a critical first step, but execution is what drives results. Knowing exactly where to place your keywords within your product listings and ad campaigns is what separates top-performing brands from the rest.

This isn’t about keyword stuffing. It's about strategic placement that communicates relevance to both Amazon's A9 algorithm and your customers.

This is where your research—from SQP data analysis to competitor intelligence—pays off. You have a validated list of terms that real people use to buy products like yours. Now, let’s map them across your Amazon presence to build a cohesive system that drives traffic, boosts conversion, and increases sales.

A Hierarchy for Keyword Placement

Not all keyword locations are created equal. Certain fields carry more weight with Amazon's algorithm and have a greater influence on a shopper's purchase decision. A hierarchical approach ensures your most important, highest-converting keywords occupy the most valuable real estate.

This strategic placement ensures you are signaling relevance and value at every touchpoint.

The Most Important Spots for Your Keywords

Here is a breakdown of where to focus your efforts, prioritized by impact.

Product Title: This is prime real estate. Your most important, highest-volume, and most relevant keyword must be here, preferably near the beginning. It's the first thing both shoppers and the algorithm see. A title like "Waterproof Hiking Backpack 50L for Camping" works significantly harder than a generic title like "Premium Outdoor Backpack."

Bullet Points (Key Features): This is your opportunity to naturally integrate primary and secondary keywords. Frame each bullet point around a key feature or benefit while including a relevant search term. For example, instead of "Durable material," write "Constructed with ripstop nylon for a tear-resistant hiking daypack."

Backend Search Terms: This is your hidden indexing tool. This space is ideal for keywords you couldn't fit naturally into your visible listing copy. Use it for common misspellings, synonyms, and long-tail variations. Remember, there's no need to repeat words already present in your title or bullet points—that's a waste of valuable space.

Weaving Keywords into Your Content and Campaigns

Beyond the core listing, A+ Content and PPC campaigns provide further opportunities to reinforce your keyword strategy.

While keywords in A+ Content are not directly indexed for organic search ranking in the same way, they are indexed for internal searches and can significantly improve your conversion rate by addressing specific customer questions and use cases.

Crucially, your PPC campaigns must align perfectly with your listing optimization. Build ad groups that are tightly themed around the keywords you've prioritized.

Your goal is a perfect marriage between your organic listing and your paid ads. When a shopper clicks an ad for "lightweight tent for backpacking," they should land on a page that immediately reinforces those exact terms in the title and bullet points. This alignment signals relevance to Amazon and builds trust with the shopper, directly boosting your conversion rate.

This process transforms your keyword list from a static document into a dynamic growth engine. Every component of your Amazon presence, from the title down to your ad copy, works in concert.

Of course, this is not a one-time setup. Continuous monitoring is essential. Our guide on keyword tracking for Amazon provides a solid framework for measuring your results and making intelligent, data-driven adjustments.

By following this hierarchy, you move from guessing to executing a structured, high-performance listing strategy. You ensure your most valuable keywords are positioned for maximum impact, turning research into traffic, conversions, and sustainable profit.

Common Questions About Finding Amazon Keywords

Even for seasoned eCommerce leaders, navigating Amazon's keyword landscape can be complex. The platform is dynamic, and last year's best practices may be today's wasted ad spend. Let's address some of the most pressing questions we hear from brands.

What’s the Difference Between Frontend and Backend Keywords?

Think of it as customer-facing versus machine-facing.

Frontend keywords are integrated into your visible product listing—the title, bullet points, and description. These must perform two functions: persuade a human customer to purchase and signal relevance to Amazon's A9 algorithm. Your most critical, high-converting keywords belong here.

Backend keywords are hidden from shoppers entirely. These are entered into the "Search Terms" field in Seller Central. This is a strategic asset, providing a dedicated space to index for keywords that don't fit naturally into your public-facing copy.

The backend is the ideal place for:

- Common misspellings and abbreviations.

- Synonyms and related terms (e.g., "couch" if your title features "sofa").

- Long-tail keyword variations that would be awkward in your primary copy.

A key best practice: Never repeat keywords from your title or bullets in the backend fields. It's redundant and provides no additional indexing benefit.

How Often Should I Refresh My Keyword Strategy?

Keyword strategy is not a "set it and forget it" activity. It's an iterative process of testing, analysis, and refinement. Customer search behavior evolves, new competitors enter the market, and seasonal trends emerge. A static strategy will inevitably lead to declining performance.

As a general rule, we recommend a comprehensive, deep-dive review of your keyword strategy each quarter. This involves pulling fresh competitor data, analyzing the latest Search Query Performance reports, and harvesting new winners from your PPC campaigns.

However, you should be reviewing your PPC Search Term Reports weekly or bi-weekly. This is your real-time feedback loop. It allows you to spot emerging customer search trends and quickly graduate new, high-performing terms into your manual campaigns and product listings.

Why Are Long-Tail Keywords So Important for Profitability?

Targeting broad, high-volume keywords like "water bottle" is often a direct path to a high ACOS. You face maximum competition, cost-per-click is inflated, and searcher intent is often ambiguous.

The real profitability lies in long-tail keywords—hyper-specific, multi-word phrases like "insulated stainless steel water bottle with straw lid."

Long-tail keywords are valuable because they are used by shoppers deep in the buying cycle. They have already conducted their initial research, know exactly what they are looking for, and their specific search query is a massive signal of purchase intent. This translates directly to higher conversion rates and a more efficient return on ad spend.

While the search volume for any single long-tail keyword is lower, the aggregate traffic from dozens of these terms can be substantial. More importantly, it's the right kind of traffic. Focusing on these specific phrases allows you to bypass the intense competition for generic terms and speak directly to shoppers who are ready to purchase your product.

At Headline Marketing Agency, we transform your raw PPC and SQP data into a cohesive keyword strategy that drives profitable growth—for both your advertising and your organic rank. We don't use generic playbooks; we build a performance-first plan from your unique data to help you dominate your category.

Ready to find the keywords that will fuel sustainable scale? Learn more about our approach at https://headlinema.com.

Ready to Transform Your Amazon PPC Performance?

Get a comprehensive audit of your Amazon PPC campaigns and discover untapped growth opportunities.